Current Trends in Bharat Dynamics Share Price

Introduction

Bharat Dynamics Limited (BDL), a leading public sector undertaking in defense and aerospace, has garnered significant attention in the stock market recently. With the growing focus on indigenous defense manufacturing as part of India’s Atmanirbhar Bharat initiative, the share price of Bharat Dynamics has become a topic of interest for investors and market analysts alike. Tracking the movements of BDL’s share price is crucial for understanding both the company’s performance and the health of the defense sector in India.

Current Share Price Overview

As of October 2023, Bharat Dynamics share price has witnessed fluctuations largely due to market sentiment and recent announcements from the Ministry of Defence. The stock opened at around ₹950 and has experienced steady growth, reaching a peak of ₹1,020 in the first week of October. Experts attribute this rise to positive quarterly earnings reports and increasing orders for missile systems. BDL has been focusing on expanding its production capabilities and diversifying its product range, which has bolstered investor confidence.

Recent Developments Impacting Share Price

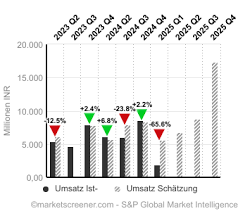

In the last quarter, Bharat Dynamics secured significant contracts including multi-year production orders for advanced missile systems, valued at over ₹3,000 crores. The company reported a year-on-year revenue growth of 27% for the second quarter of FY 2023-24, contributing to the increase in its stock price. These developments align with India’s push to enhance defense capabilities and reduce reliance on foreign imports, further solidifying BDL’s market position.

Market Analysts’ Insights

Market analysts are optimistic about the future of Bharat Dynamics share price. With the government allocating more funds to defense in the recent budget, the demand for BDL’s products is expected to rise. Analysts suggest that the share price could potentially reach ₹1,200 by the end of 2023 if the current trends continue. Analysts also note that while BDL’s stock is currently on an upward trajectory, investors should be cautious of market volatility and the impacts of geopolitical tensions on defense spending.

Conclusion

With continued investments in defense and aerospace, along with a strong order book, Bharat Dynamics Limited presents a compelling case for both short-term and long-term investors. As the Indian government continues to prioritize domestic production, the prospects for BDL appear promising. Monitoring changes in market dynamics and government policies will be essential for investors looking to make informed decisions regarding Bharat Dynamics share price. The upcoming months will be crucial as BDL approaches the end of the fiscal year, ending on a strong note could significantly enhance its stock appeal.