Current Trends in Bharat Dynamics Share Price

Understanding Bharat Dynamics and Its Market Relevance

Bharat Dynamics Limited (BDL) is a key player in the Indian defence sector, specializing in manufacturing missiles and related systems. With growing government emphasis on indigenous defence production, BDL has captured significant investor attention. This article sheds light on the latest share price trends, market positions, and forecasted movements of Bharat Dynamics stock.

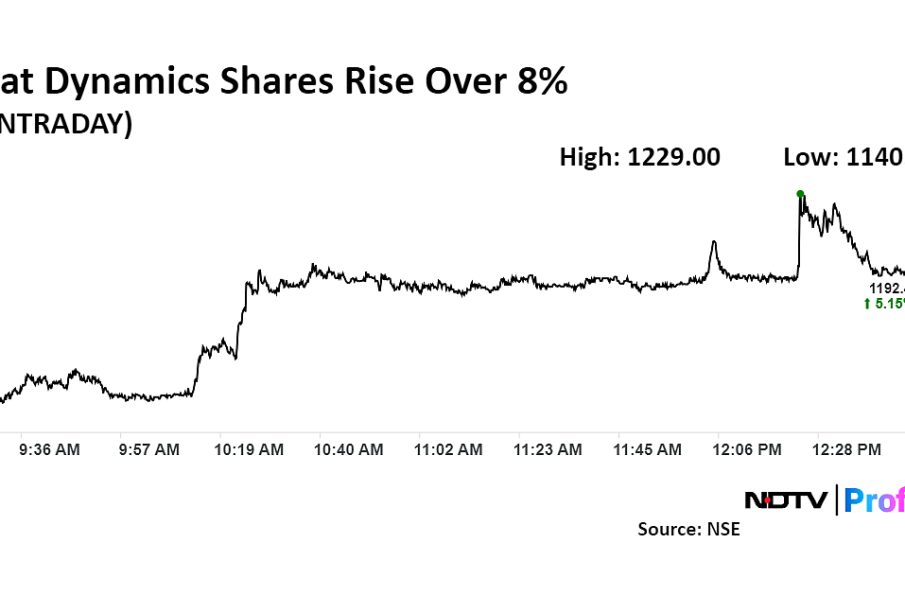

Recent Performance and Market Trends

As of mid-October 2023, Bharat Dynamics share price is around INR 900, marking a steady increase of approximately 15% over the past month due to positive quarterly earnings, which were reported to be higher than analysts’ expectations. The company has recently announced new orders worth over INR 2,000 crore, further bolstering investor confidence.

Moreover, the Indian government’s push for self-reliance in defence manufacturing, aligned with initiatives such as “Atmanirbhar Bharat,” is expected to drive future growth for companies like BDL. Given these factors, analysts believe that the stock may continue its upward trajectory, especially as the demand for defence equipment rises amid geopolitical tensions in the region.

Expert Recommendations and Future Outlook

Market analysts are broadly optimistic about BDL’s share price, with some projecting a target price of INR 1,100 over the next six months. They recommend that investors may treat current price dips as buying opportunities, given BDL’s robust order backlog and potential for expansion into international markets.

However, investors are advised to remain cautious amid market volatility. The defence sector can be subject to political influences, and any delays in government contracts could impact BDL’s stock performance. Therefore, a diversified portfolio and careful assessment of market conditions are advisable for potential investors.

Conclusion

Bharat Dynamics share price is currently attractive for investors looking into the defence sector. With governmental support and ongoing defense efforts, the share price is expected to rise. As always, staying informed and reassessing market conditions will be crucial in determining the right investment strategies.