Current Trends in BEL Share Price: October 2023

Introduction

The share price of Bharat Electronics Limited (BEL) is a key indicator of the company’s market performance and investor sentiment. As a leading manufacturer of defense equipment in India, BEL plays a significant role in the country’s defense landscape. Understanding the fluctuations in BEL’s share price is crucial for investors, analysts, and those interested in the defense sector, especially given the ongoing geopolitical tensions and government initiatives that may affect public sector undertakings.

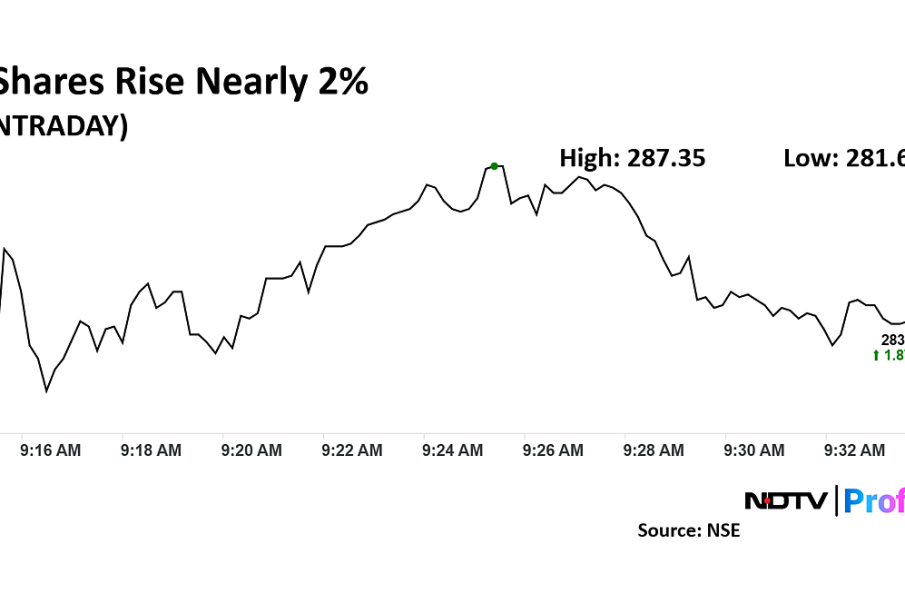

Current Stock Performance

As of October 2023, the share price of BEL has experienced notable volatility, primarily influenced by macroeconomic factors and fluctuations in the defense industry. Currently, BEL shares are trading around ₹140 per share, reflecting a 5% increase from the previous month. Analysts attribute this rise to the government’s increased defense budget, which has positively impacted defense manufacturing companies, including BEL.

Market Influences

Several key factors have influenced BEL’s share price in recent weeks. The government of India has announced an increase in defense spending, with a focus on modernization and self-reliance in defense production. This move is expected to provide substantial growth opportunities for BEL. Furthermore, recent quarterly results released by the company showed an increase in revenue and profit margins, which is a positive signal for investors.

Industry Sentiment

Investor sentiment surrounding BEL remains cautiously optimistic. Shareholders are encouraged by the company’s prospects in the context of rising global tensions, which have elevated the importance of strengthening national defense capabilities. Additionally, BEL’s continued investment in new technologies and research and development is expected to yield positive results in the future, further boosting investor confidence.

Conclusion

In conclusion, the share price of BEL as of October 2023 reflects favorable market conditions and strategic government initiatives supporting the defense sector. With its strong performance in recent quarters and prospects for future growth driven by increased defense spending, investors may find BEL to be a compelling option. However, potential investors should stay informed of market dynamics and remain aware of the broader implications of geopolitical developments that may impact BEL’s performance. Overall, the outlook for BEL’s share price remains positive as it aligns with national interests and technological advancements in defense.