Current Trends in Bank of Maharashtra Share Price

Introduction

Bank of Maharashtra, a major public sector bank in India, plays a significant role in the financial sector. Understanding its share price is crucial for investors who are looking to navigate the stock market especially in a fluctuating economy. Recent events surrounding the bank’s performance, market trends, and overall economic conditions have made its share price a topic of keen interest among investors and analysts alike.

Current Share Price Performance

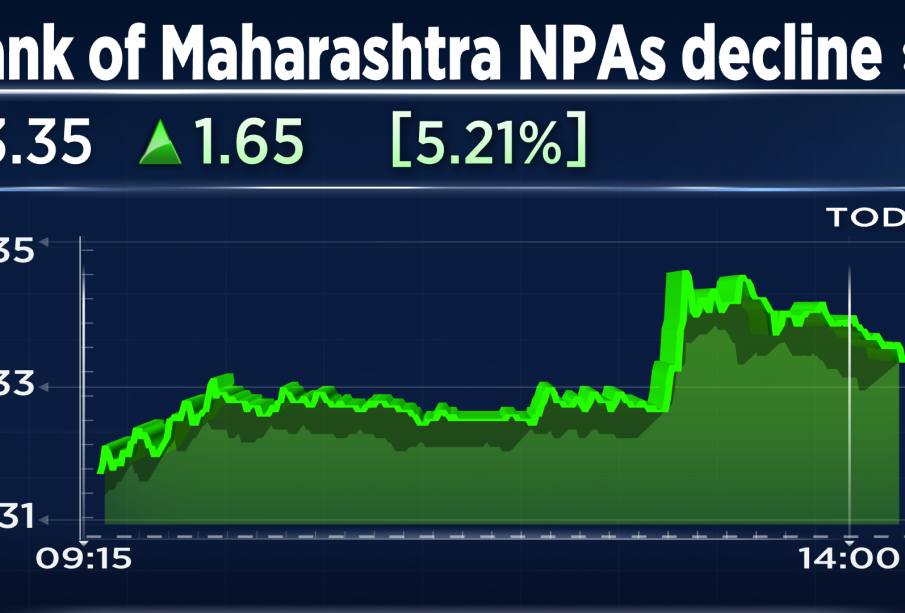

As of mid-October 2023, the share price of Bank of Maharashtra is experiencing notable fluctuations. The stock has shown a positive trend in the last quarter, with shares trading around INR 36.50, a significant increase from the previous quarter. According to market analysts, this rise can be attributed to the bank’s robust performance in terms of lending growth and improvement in asset quality.

The bank reported a net profit of INR 788 crore for the second quarter of the fiscal year 2023-24, which was a remarkable increase compared to previous quarters. The bank has also been focusing on increasing its retail loan portfolio, which has contributed positively to its overall financial health.

Market Influences

Multiple factors are influencing the share price of the Bank of Maharashtra. The broader market conditions, including changes in interest rates and economic policies, are significant contributors. Additionally, the Reserve Bank of India’s monetary policy announcements can also impact the banking sector’s performance immensely.

Another key aspect affecting the stock is investors’ sentiments and predictions. With increasing competition among public sector banks and the introduction of digitization in banking services, how Bank of Maharashtra adapts to these changes will likely influence its future share performance.

Conclusion

In conclusion, the share price of Bank of Maharashtra is witnessing considerable attention due to its recent financial performance and market conditions. Investors are advised to monitor not just the share price but also the bank’s strategic initiatives and economic indicators closely. Given the current trends, analysts forecast a cautiously optimistic outlook for the bank, suggesting that long-term investments in its shares could prove fruitful as it continues on its path of modernization and expansion. Keeping abreast of both macroeconomic factors and the bank’s internal metrics will be essential for making informed investment decisions.