Current Trends in Avanti Feeds Share Price

Introduction

Avanti Feeds Ltd, a prominent player in the aquaculture industry, has garnered significant attention from investors and analysts alike due to its rapidly evolving market dynamics. The share price of Avanti Feeds is not only essential for current shareholders but also for potential investors and market analysts who are closely monitoring the aquaculture sector’s growth in India. Given the rising demand for seafood and shrimp exports, understanding Avanti Feeds’ stock performance can provide deeper insights into the broader economic landscape.

Recent Performance

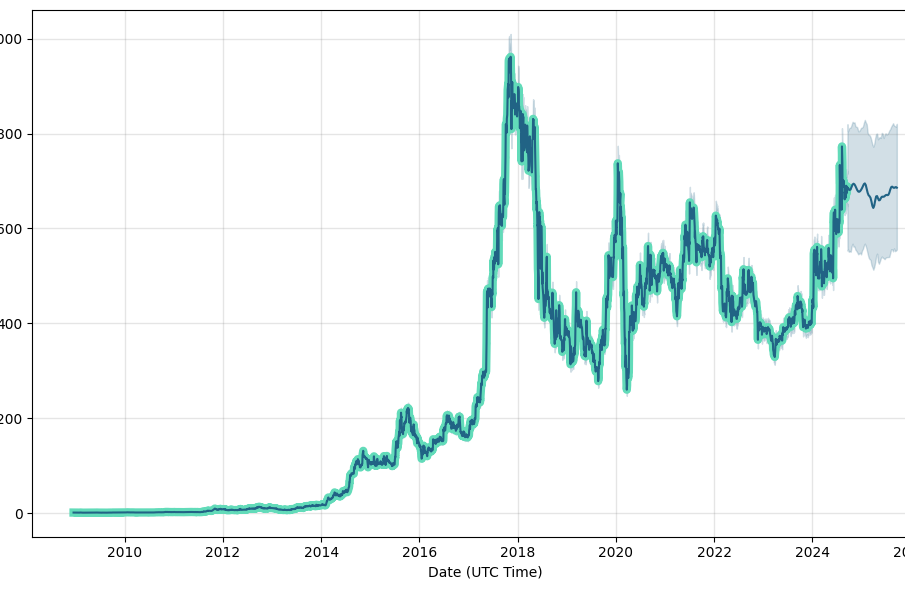

As of October 2023, Avanti Feeds shares have experienced notable fluctuations in price. The stock opened at ₹655.00 in the beginning of the month, and after a few ups and downs, it settled around ₹700.00 by mid-October, reflecting a robust trend in demand for aquaculture products. Analysts attribute this rise to various factors, including increased domestic consumption and robust export performance driven by favorable government policies.

Market Influences

Several factors influence the price of Avanti Feeds shares. Key market influences include fluctuations in global shrimp prices, changes in regulatory policies affecting export and domestic sales, and the company’s financial performance, including quarterly earnings reports. In its recent quarterly results, Avanti Feeds reported a significant increase in net profits, which positively impacted its share price. The company’s expansion into new markets and investments in technology also promise to strengthen its position in the industry.

Future Outlook

Looking forward, market analysts remain optimistic about the future of Avanti Feeds share price. With the government’s continual support for aquaculture, including subsidies and incentives for shrimp farmers, the company is well-poised for growth. However, challenges such as rising production costs and international competition may affect profitability. Analysts expect the share price to remain volatile but project a long-term upward trajectory as the company continues to innovate and expand its operations.

Conclusion

The share price of Avanti Feeds is indicative of the health and potential of the aquaculture sector within India. For investors, understanding these trends and upcoming market shifts is crucial for making informed decisions. As demand for seafood products increases globally, Avanti Feeds is likely to witness a robust growth pattern, making it a stock worth monitoring in the coming months. Investors should continue to keep an eye on company announcements, market conditions, and global seafood trends to gauge the future of Avanti Feeds shares.