Current Trends in Ather Energy Share Price

Introduction

Ather Energy, a pioneer in the electric vehicle (EV) market in India, has garnered significant attention since its inception. As the demand for sustainable transportation solutions increases, the tracking of Ather Energy’s share price has become crucial for investors and market analysts alike. Understanding its trajectory can provide insights into the broader EV market, which is rapidly evolving amid government incentives and a shift towards green energy solutions.

Recent Performance

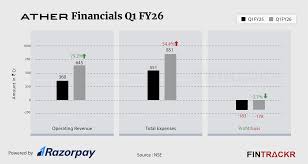

As of October 2023, Ather Energy’s share price has experienced notable fluctuations, reflecting both market conditions and investor sentiment regarding the EV sector. The share price recently reached an all-time high of ₹1,250 per share after a robust quarterly performance report highlighted their production milestones and expansion plans. Analysts had forecasted this growth, attributing it to increasing sales figures and the growing adoption of electric scooters in urban areas.

Furthermore, sectoral challenges such as supply chain disruptions and rising raw material costs have been factored into Ather’s stock performance. Despite these concerns, Ather’s proactive measures in scaling production and enhancing distribution channels have bolstered investor confidence.

Market Sentiment and Future Outlook

Investor sentiment remains generally optimistic about Ather Energy’s long-term prospects. The company is strategically positioned to benefit from government initiatives aimed at promoting electric vehicle adoption, including subsidies and financial incentives for EV manufacturers and consumers. The recent introduction of new models anticipated to hit the market in early 2024 has further fueled enthusiasm among investors.

However, market experts caution that the EV sector is still in its infancy in India and that competition is expected to intensify with more players entering the market. Thus, while Ather Energy is currently a strong contender, fluctuations in share prices can still occur based on market dynamics and regulatory developments.

Conclusion

The performance of Ather Energy’s share price is indicative of the larger trends in the Indian EV market, which is poised for significant growth. As the company continues to innovate and expand its product line, investors are keenly watching its movement in the stock market. The next few quarters will be pivotal in determining whether Ather can maintain its strong position amidst evolving market conditions. For stakeholders, understanding these trends is essential for making informed investment decisions in this rapidly changing landscape.