Current Trends in Apollo Micro Systems Share Price

Introduction

Apollo Micro Systems, a leading player in the communication and electronic industry, has been a topic of interest among investors and market analysts lately. The company’s share price is crucial not just for its stakeholders but also for those tracking the broader trends in technology-driven sectors of the economy. Understanding the factors influencing Apollo Micro Systems’ share price can provide insights into market confidence in this innovative company.

Current Share Price Overview

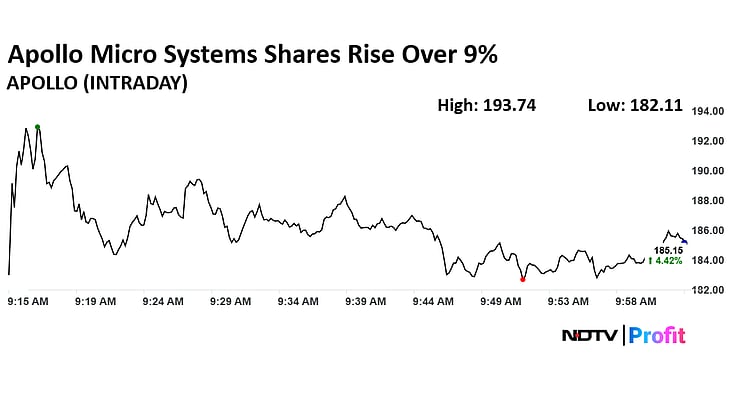

As of the latest trading session, Apollo Micro Systems shares have shown resilience amidst market fluctuations. The stock was trading at approximately ₹200 per share, reflecting a steady growth trend over the past month. This growth can be attributed to the company’s robust order book and positive outlook on the defense and aerospace sector, where it has established a strong presence.

Influencing Factors

Several factors have contributed to the increase in the share price of Apollo Micro Systems:

- Strong Financial Performance: The company reported a year-on-year increase in revenue and profits, indicating solid operational performance.

- Government Contracts: Recent contracts awarded by the Indian government for defense projects have fueled investor optimism, further driving the stock price upward.

- Market Sentiment: Positive sentiment in the Indian stock market, particularly in the technology and defense sectors, has boosted investor confidence in Apollo Micro Systems.

Market Predictions

Analysts predict that if the company continues to secure contracts and provide innovative solutions, its share price may see further growth. Projections indicate that the price could potentially reach ₹250-₹300 in the coming months, driven by sustained demand from both domestic and international markets.

Conclusion

In conclusion, Apollo Micro Systems’ share price is reflective of the company’s strategic position in a lucrative sector. For investors, keeping an eye on the company’s performance, market developments, and external economic factors will be crucial in making informed investment decisions. As the defense and aerospace sectors continue to evolve, Apollo Micro Systems stands to benefit greatly, making its share price an important indicator of market trends in the technology and defense industries.