Current Trends in AMD Share Price

Introduction

The share price of Advanced Micro Devices, Inc. (AMD) has been a topic of considerable interest among investors and analysts alike, particularly as the technology sector experiences fluctuating dynamics. With the rise of artificial intelligence (AI) and the increased demand for semiconductor solutions, AMD’s stock movements have significant implications not just for the company, but also for the broader market. Keeping an eye on these trends is crucial for stakeholders and potential investors in the tech field.

Recent Performance of AMD Share Price

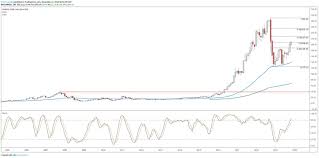

As of late October 2023, AMD’s share price has shown considerable volatility. Currently trading at approximately $95 per share, it has seen fluctuations driven by earnings reports, supply chain dynamics, and competition with rival Intel. The recent performance indicates a 15% increase over the last month, reflecting investor optimism following AMD’s quarterly earnings that exceeded market expectations.

Earnings Report Analysis

In Q3 2023, AMD reported a revenue increase of 20% year-over-year, primarily fueled by a surge in demand for processors used in AI applications and data center products. The company also announced strategic partnerships that are poised to integrate its technologies within more enterprise solutions. Investor reactions to these developments contributed to the upward momentum of its share price.

Market Sentiment and Analyst Predictions

Market analysts exhibit a mixed sentiment regarding AMD’s future. A number of experts have raised price targets to as high as $115, reflecting confidence in its product pipeline and market strategies. However, concerns about potential supply chain issues and the competitive landscape remain, particularly with the rise of Nvidia in the AI and graphics market.

Conclusion

In summary, AMD’s share price remains a critical focus for investors, especially considering the ongoing trends in technology and AI. The company’s robust performance in Q3 2023 has established a solid foundation for potential future growth, though challenges remain. As markets continue to evolve rapidly, AMD will need to navigate its competition strategically while possibly experiencing significant stock price movements in the coming months. Keeping up with these developments will be vital for anyone invested in or considering AMD shares.