Current Trends in Airtel Share Price: An Overview

Importance of Airtel Share Price

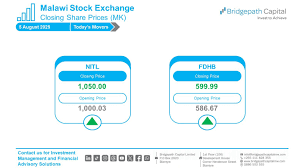

The share price of Bharti Airtel, one of India’s leading telecommunications service providers, is not just a number; it represents the overall health of the company in the stock market. As of late 2023, understanding Airtel’s share price movements is crucial for investors and stakeholders, given its implications on market confidence, investment strategies, and future growth prospects.

Recent Trends in Airtel Share Price

As of October 2023, Airtel’s share price has shown significant fluctuations, influenced by various factors such as quarterly earnings reports, regulatory changes, and market competition. Following the announcement of robust quarterly earnings, which exceeded market expectations, Airtel’s share price hit an all-time high of ₹800 per share, reflecting a surge of approximately 15% over the past two months.

Analysts predict that the company’s focus on expanding 5G services and improving customer service integration may continue to drive its share price upward. Furthermore, Airtel’s strategic partnerships and investments in technology serve to reassure investors of a solid growth trajectory.

Market Reactions and Investor Sentiments

The recent positive trend in Airtel’s share price has garnered considerable attention from both domestic and international investors. Investment firms have revised their price targets for Airtel to reflect the positive sentiment surrounding its long-term growth prospects. One of the key factors contributing to this bullish outlook is the growing demand for digital services, particularly as more consumers shift towards digital platforms for entertainment and communication.

Future Outlook for Airtel Share Price

Looking ahead, analysts suggest that Airtel’s share price may continue to experience volatility, influenced by macroeconomic factors and competitive dynamics in the telecommunications space. With the ongoing rollout of 5G services and potential government policy changes to promote digital infrastructure, Airtel is well-positioned to capitalize on expanding market opportunities.

Conclusion

In conclusion, monitoring the Airtel share price is essential for investors looking to understand the company’s future performance and investment potential. As Airtel adapts to market changes and continues to innovate in technology and services, its share price will be a key indicator of its overall success and a vital consideration for investment strategies in the telecom sector.