Current Trends and Predictions for Tesla Share Price

Introduction

Tesla Inc., the electric vehicle (EV) manufacturer founded by Elon Musk, has been a key player in the automotive and tech industries. With the growing emphasis on sustainability and electric transportation, the Tesla share price has gained significant attention from investors and analysts alike. As of late 2023, amidst market fluctuations and economic pressures, understanding the factors that influence Tesla’s share price is critical for current and potential investors.

Recent Performance and Market Trends

As of October 2023, Tesla’s share price has experienced notable volatility, reflecting broader trends in the stock market. After reaching an all-time high in 2021, which peaked around $900 per share, the stock saw corrections throughout 2022, driven by factors such as inflation, interest rate hikes, and supply chain disruptions. However, the market landscape for electric vehicles has shifted once again, favorably impacting Tesla. Recently, the stock price has hovered around $250 per share, showing signs of recovery as demand for EVs continues to rise and Tesla expands its production capabilities.

Key Factors Impacting Tesla’s Share Price

Several factors play a crucial role in determining the share price of Tesla. Firstly, the company’s quarterly earnings reports influence investor confidence. In Q2 of 2023, Tesla reported an increase in revenue, largely due to strong sales in the Chinese market, showcasing its global reach. Secondly, the ongoing competition from other automotive giants entering the EV space has significant implications for Tesla’s market share and growth potential. Brands like Ford, General Motors, and newer entrants such as Rivian are poised to affect Tesla’s dominance.

Moreover, external factors such as government regulations, subsidies for electric vehicle purchases, and consumer behavior shifts towards sustainability are key drivers of Tesla’s stock performance. The Biden administration’s push for green energy and electric vehicles has also provided a conducive environment for companies like Tesla.

Future Predictions

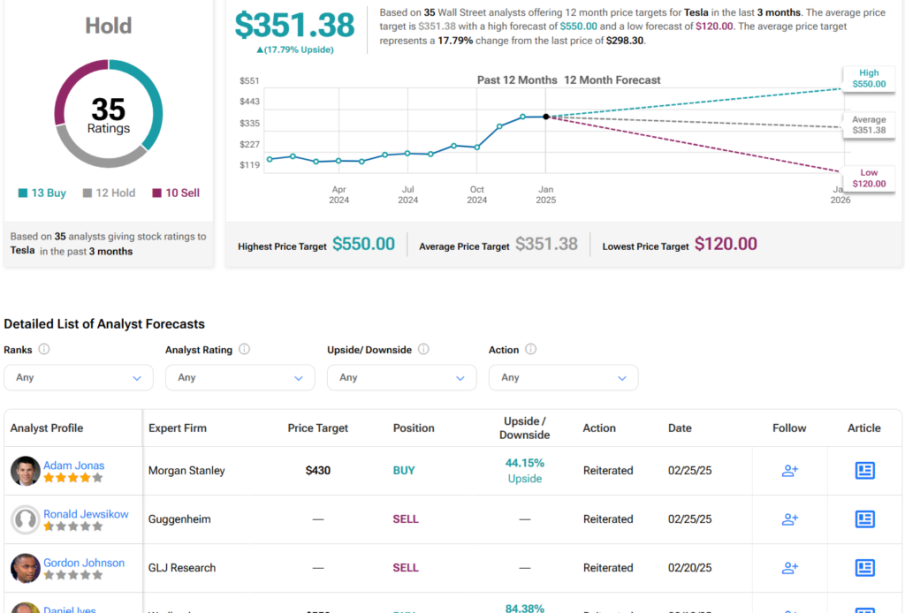

Looking ahead, analysts remain divided on the direction of Tesla’s share price. Some predict a bullish outlook driven by expanding production capabilities and innovation, particularly in battery technology and autonomous driving solutions. Others caution against potential market saturation or economic downturns that could impact consumer spending.

Conclusion

In summary, the Tesla share price remains a focal point for investors as it is influenced by a confluence of internal company performance, industry competition, and macroeconomic factors. While short-term volatility may continue as the market adjusts, the long-term prospects for Tesla depend on its ability to innovate and adapt to changing market conditions. Investors should keep an eye on production milestones, market trends, and policy changes in the EV sector to navigate the complexities surrounding Tesla’s share price effectively.