Current Trends and Insights on ICICI Bank Share

Introduction

In recent years, ICICI Bank has established itself as one of the leading private sector banks in India. With a strong portfolio of financial services and a robust digital banking platform, the bank’s shares have attracted significant attention from investors and market analysts alike. Understanding the current performance and trends in ICICI Bank’s share price is crucial for investors looking to make informed decisions in the stock market.

Current Performance of ICICI Bank Shares

As of October 2023, ICICI Bank shares are experiencing a positive trajectory amid favorable market conditions. The stock is currently trading around INR 850, marking a steady increase compared to previous months. Analysts attribute this growth to the bank’s strong quarterly earnings, which exceeded market expectations by a substantial margin.

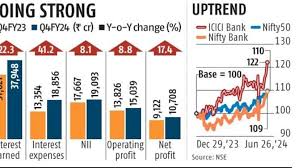

ICICI Bank’s net profit for the second quarter of the fiscal year 2023-24 rose by 25% year-on-year, reaching INR 7,500 crore. This impressive performance is primarily driven by robust loan growth, improved asset quality, and a significant reduction in non-performing assets (NPAs), which have fallen below 2%. Such metrics underline the bank’s financial health and potential for future growth, making its shares a popular choice among investors.

Market Sentiment and Investor Interest

The general sentiment surrounding ICICI Bank shares remains optimistic. Various brokerage firms have updated their ratings, with many suggesting a ‘Buy’ stance. The bank’s forward-looking strategies, such as focusing on digital innovations and expanding its retail lending portfolio, further enhance investor confidence.

Additionally, the ongoing digital transformation in the banking sector has positioned ICICI Bank as a leader in providing modern banking solutions. The bank’s successful mobile app and online services have attracted younger customers, contributing to its growing market share.

Conclusion

In conclusion, ICICI Bank shares are currently witnessing a positive trend owing to strong financial performance and favorable market conditions. As the bank continues to innovate and expand its services, investors are likely to remain interested in its stock. Keeping an eye on the bank’s upcoming strategic moves and market developments will be essential for potential investors. With the right information and understanding of market dynamics, investors can make informed decisions and potentially benefit from the promising future of ICICI Bank shares.