Current Trends and Insights on HEG Share Price

Introduction

The share price of HEG Limited (a prominent player in the graphite electrode industry) is a significant indicator of market trends and investor sentiment in the Indian stock market. Investors are keenly observing the fluctuations in HEG’s share price, especially given the company’s critical role in various sectors, including steel manufacturing. Understanding these trends is crucial for both seasoned investors and new market entrants looking to navigate the complexities of stock investments.

HEG Limited Overview

HEG Limited was established in 1972 and is known for producing graphite electrodes primarily used in the electric arc furnace steel manufacturing process. It has positioned itself as a leading name in the graphite electrode sector worldwide. The company’s performance is closely tied to the demand for steel, making its share price a significant factor in the broader market analysis.

Recent Trends

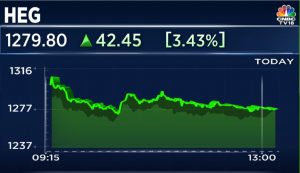

As of October 2023, HEG’s share price has shown considerable volatility, reflecting the wider fluctuations in the stock market. Recent reports indicate that the share price has ranged from ₹1,150 to ₹1,500 over the last few months, driven by changes in demand for graphite electrodes and shifts in the global steel market. The company reported a robust quarterly revenue, boosting investor confidence, yet faced challenges such as rising raw material costs, which have affected margins.

Market Reactions and Analysis

Analysts are currently projecting a cautious outlook for HEG shares as they respond to both company-specific news and the global economic context. Factors such as U.S-China trade relations, global steel production forecasts, and the regulatory environment in India have been underscoring the recent movements in HEG’s share performance. Additionally, the emergence of alternative materials in the steel production industry may also play a role in shaping investor sentiment moving forward.

Conclusion

The HEG share price continues to resonate with the dynamics of not only the company itself but also wider macroeconomic factors. Investors are advised to keep a close watch on quarterly results, international trade policies, and raw material cost fluctuations that can affect profitability. With ongoing developments in both the domestic and global markets, the future trajectory of HEG’s share price remains an area of keen interest and speculation. As always, prudent investment strategies, extensive market research, and a keen awareness of market fluctuations will be essential for making informed decisions in this sector.