Current Trends and Insights on Global Indices

Importance of Global Indices

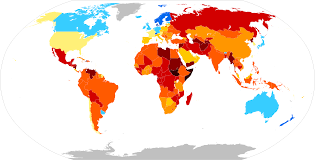

Global indices serve as vital indicators of the financial health and performance of markets across the world. They reflect the market trends, investor sentiment, and economic conditions in various regions. Understanding these indices can provide investors and stakeholders with critical insights into market movements and potential investment opportunities.

Recent Developments

As of October 2023, several global indices have exhibited significant fluctuations influenced by various factors including geopolitical tensions, inflation rates, and monetary policy adjustments. The S&P 500, a key indicator of the U.S. stock market, has seen a 5% rise over the past month due to positive earnings reports from major corporations. Similarly, the FTSE 100 in the UK has experienced a 4% uptick, mainly driven by recovery in the energy sector amid rising oil prices.

In Asia, the Nifty 50 index in India has also surged by 3%, supported by robust economic growth forecasts and steady foreign investments. Analysts attribute this growth to India’s strong domestic demand and a promising business environment, bolstered by ongoing reforms.

Factors Affecting Global Indices

The fluctuations in global indices can be linked to several global economic indicators. Inflation concerns have been a recurrent theme, with central banks around the world adjusting interest rates in response to fluctuating price levels. For instance, the Federal Reserve’s recent hints at maintaining higher interest rates have caused mixed reactions in markets, influencing investor strategies.

Geopolitical concerns, especially related to ongoing conflicts and trade negotiations, continue to loom large over market sentiment. The recent developments in Eastern Europe and their ramifications on energy supply chains have also made global investors wary, leading to increased volatility in energy sector stocks.

Conclusion: Implications for Investors

In conclusion, the state of global indices remains a crucial area for market watchers and investors alike. As fluctuating conditions driven by both economic and geopolitical factors continue, staying informed on these trends is imperative. Predictions suggest that if the inflationary pressures ease and geopolitical stability is achieved, we might see sustained recovery in global indices through the upcoming quarters.

Investors should remain vigilant and consider diversifying their portfolios to mitigate risks associated with market volatility. Understanding the functioning of global indices and their indicators can empower investors to make better-informed decisions.