Current Trends and Insights on BHEL Share Price

Introduction

The share price of Bharat Heavy Electricals Limited (BHEL), one of India’s largest engineering and manufacturing companies, is a significant topic for investors and analysts alike. BHEL operates primarily in the power generation sector and is deeply involved in the manufacturing of heavy electrical equipment. The fluctuations in its share price are crucial indicators of the company’s performance and investor sentiment towards the capital goods sector.

Current Market Overview

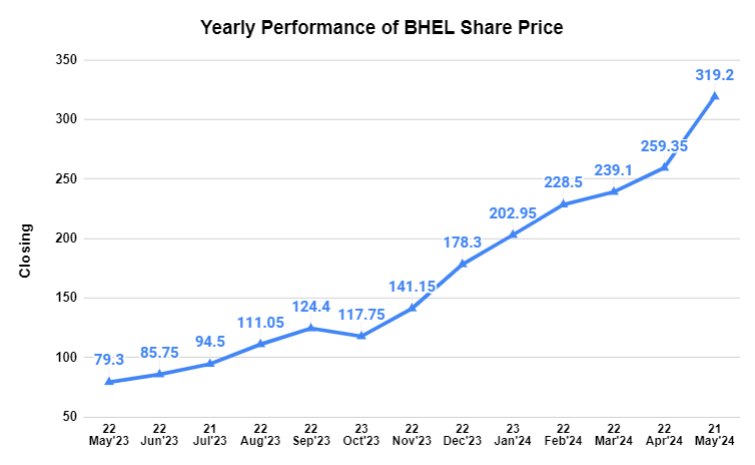

As of October 2023, BHEL’s share price has shown noteworthy volatility influenced by several factors including quarterly earnings, raw material costs, and government policies regarding infrastructure development. Recent trends have seen BHEL’s share price oscillating between ₹70 and ₹80, reflecting both positive and negative market reactions.

Recent Performance and Analysis

The financial results for Q2 FY2024 released by BHEL revealed a rise in revenue compared to the previous quarter, giving a slight boost to investor confidence. A significant order win from NTPC for 800 MW thermal power plants has also pushed up predictions about future earnings, leading to optimistic sentiments in the market.

Factors Influencing BHEL’s Share Price

There are numerous factors currently impacting BHEL’s share price, including:

- Government Policies: With the Indian government’s focus on renewable energy and infrastructure development, orders from public sector undertakings are vital for BHEL.

- Raw Material Costs: Increasing costs of steel and other materials potentially pressure profit margins, affecting stock performance.

- Market Competition: Competition from both domestic and international companies can influence market share and profitability.

Investor Sentiment and Future Forecast

Analysts suggest that the focus on renewable energy could benefit BHEL if they adapt quickly to changing industry dynamics. Investors are advised to keep an eye on both global supply chain issues and domestic policy shifts that may impact procurement costs. Overall, market analysts remain cautiously optimistic about BHEL’s stock, pending strong order books and potential infrastructure push from the government.

Conclusion

In conclusion, BHEL’s share price reflects broader trends in the Indian economy and specifically the power sector. It remains critical for investors to stay informed about new developments and financial disclosures from BHEL as they will provide insights into the company’s future trajectory. Keeping a close eye on both micro and macroeconomic factors will be essential for navigating the coming weeks in this evolving market landscape.