Current Trends and Insights on BDL Share Price

Introduction

Bombay Dockyard Limited (BDL) is an essential player in India’s defense sector and is listed on the stock exchange, making its share price a topic of keen interest among investors. Understanding BDL’s share price trends is crucial for those looking to invest in defense manufacturing and to predict market movements. As the Indian government continues to focus on self-reliance in defense, monitoring BDL’s stock performance can provide investors with valuable insights.

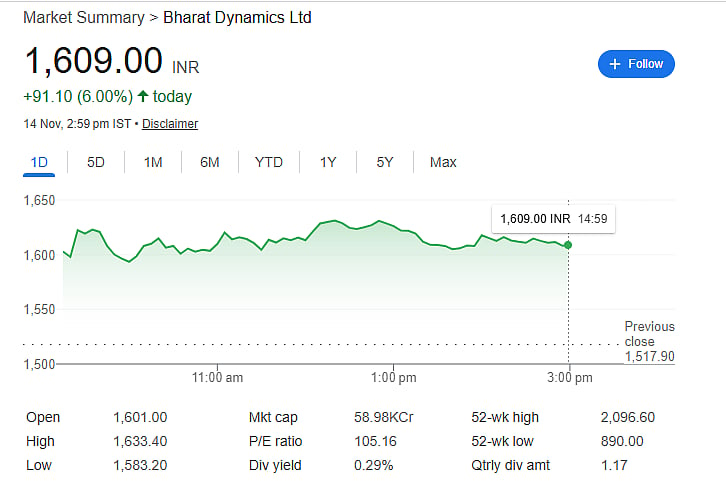

Recent Performance

As of October 2023, the BDL share price has seen fluctuations due to various factors including market sentiment, geopolitical tensions, and government defense contracts. Recently, BDL’s share price touched an all-time high of INR 470 in early September, reflecting positive earnings reports and increased defense allocations in the union budget. However, the stock pulled back to around INR 440 by the end of September, largely influenced by broader market corrections and profit-booking trends among investors.

Factors Influencing BDL Share Price

The BDL share price is significantly impacted by several key factors:

- Government Policies: Initiatives like ‘Make in India’ and increased defense spending by the government directly influence demand for BDL’s products.

- Global Supply Chain Dynamics: Disruptions in global supply chains can impact production costs and timelines, affecting investor confidence.

- Market Sentiment: Overall market health, investor sentiment towards defense stocks, and macroeconomic indicators play a critical role in BDL’s stock performance.

Future Outlook

Looking ahead, analysts remain cautiously optimistic about BDL’s potential for growth. The company’s involvement in strategic defense projects and potential international contracts could bolster its market position. Moreover, as India seeks to bolster its military capabilities, BDL’s role is expected to expand, potentially leading to an increase in share price.

Conclusion

For investors, keeping a close eye on the BDL share price trends is vital, especially in the context of ongoing defense reforms. While challenges remain, the long-term outlook for BDL appears promising, making it a stock worthy of consideration for those interested in the defense sector. Staying informed about policy changes and global market trends will be essential for making informed investment decisions.