Current Trends and Influences on Titan Share Price

Introduction

The share price of Titan Company Ltd, one of India’s leading manufacturers of watches, jewelry, and eyewear, has garnered significant attention in the financial market. Tracking its share price is crucial for investors, analysts, and the general public, as it reflects the company’s performance and broader economic trends. As the stock market navigates through various challenges, understanding Titan’s share price movements can provide insights into consumer behavior and the luxury goods sector.

Current Market Overview

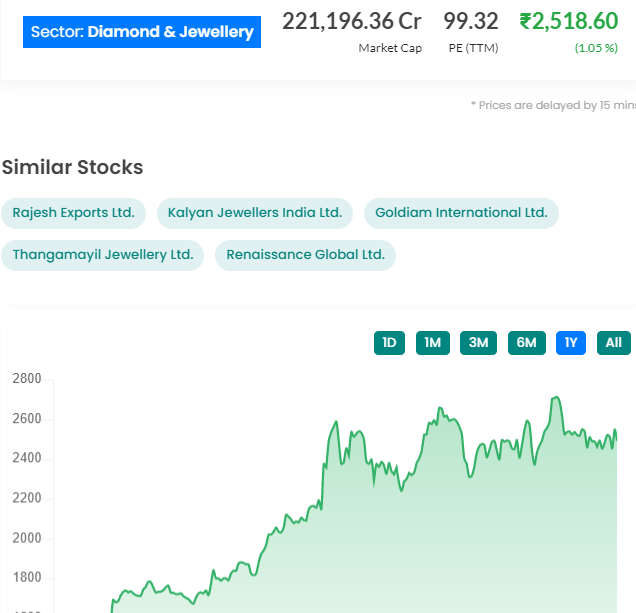

As of October 2023, Titan’s share price has shown a volatile trend, influenced by various factors including global economic conditions, consumer demand, and the company’s financial performance. Recently, Titan’s stock was trading at approximately INR 2,350 per share, experiencing a slight decline of 2% over the week. This fluctuation comes amidst a broader sell-off in the equities market driven by inflationary pressures and the Federal Reserve’s interest rate decisions.

Factors Influencing Titan Share Price

Several key events have shaped the trajectory of Titan’s share price:

- Quarterly Earnings Report: Titan reported strong second-quarter earnings, showcasing a 15% increase in revenue year-on-year. The jewelry segment, which constitutes the majority of Titan’s sales, reported substantial growth due to increased consumer spending during festivals.

- Consumer Sentiment: With the festive season approaching, consumer sentiment is expected to bolster demand for luxury goods, potentially driving Titan’s share price higher.

- Global Economic Conditions: The ongoing geopolitical tensions and supply chain disruptions have wary investors closely monitoring the luxury goods market, including brands like Titan.

Conclusion

In conclusion, Titan’s share price is under continuous scrutiny as it is influenced by a variety of factors spanning corporate performance to macroeconomic conditions. Investors are advised to remain cautious, given the current market volatility, while also being mindful of Titan’s strong fundamentals that could indicate potential long-term growth. As Titan continues to innovate and tap into burgeoning consumer demand, its share price may stabilize and even rise in the near future. The company’s strategic initiatives in expanding its retail footprint and product lines could ultimately prove beneficial, reinforcing its place in the luxury and lifestyle sector of India.