Current Trends and Forecasts of GTL Infra Share Price

Importance of GTL Infra Share Price

The share price of GTL Infrastructure Limited, commonly known as GTL Infra, is a critical metric for investors assessing the performance of the telecommunications infrastructure sector in India. With increasing smartphone penetration and demand for data services, understanding fluctuations in GTL Infra’s share price can provide insights into the broader telecom market trends.

Current Market Performance

As of October 2023, GTL Infra’s share price has demonstrated significant volatility, reflecting both local and global economic conditions. The stock has shown a recent uptick, with a current price hovering around ₹45 per share, a rise of approximately 4% in the past month. Analysts suggest that this increase is driven by the growing demand for telecom towers and infrastructure following the surge in mobile data consumption across India.

Investors and analysts are closely monitoring the company’s performance due to multiple factors impacting the sector, including the recent rollout of 5G services and increased capital investment in telecommunications infrastructure. The company has reported a steady increase in revenue, which has further bolstered investor confidence.

Factors Influencing GTL Infra Share Price

A range of factors affect GTL Infra’s share price trajectory, including:

- Regulatory Changes: New policies concerning the telecom infrastructure can either facilitate growth or present challenges affecting share prices.

- Market Competition: Intense competition among telecom operators can impact the company’s ability to secure new contracts.

- Financial Results: Quarterly financial results are crucial for shareholders, and positive earnings can lead to significant valuation increases.

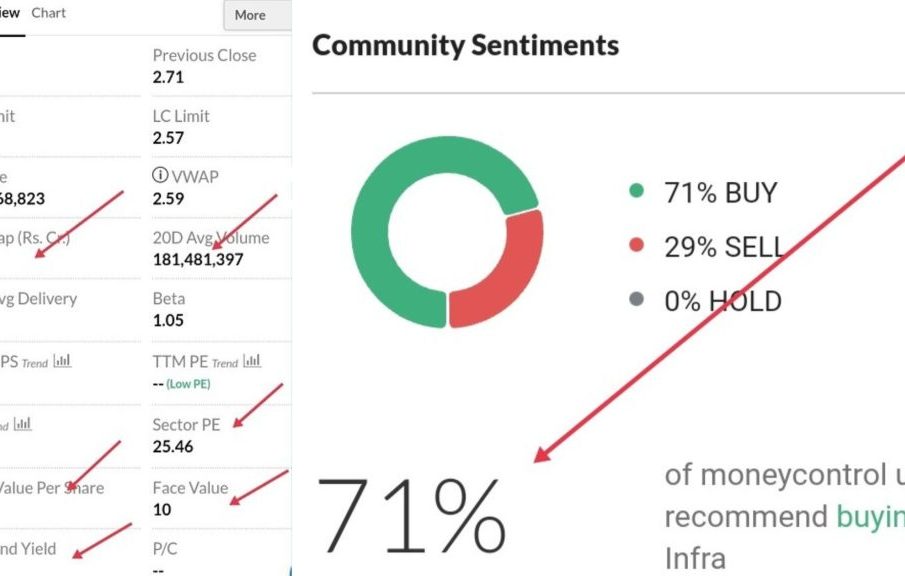

Investor Sentiment and Forecast

Given the current trend in GTL Infra’s share price, market analysts maintain a cautiously optimistic outlook. Forecasts suggest that if the growth rate in data consumption continues alongside the company’s strategic initiatives to expand its infrastructure reach, the share price could witness further appreciation.

However, potential investors should stay updated on sector-specific news and economic developments that may impact the stock. It is recommended for investors to conduct thorough research and consider market conditions before making investment decisions related to GTL Infra shares.

Conclusion

In summary, GTL Infra’s share price remains a vital indicator of the company’s health and market dynamics within the telecommunications sector. Investors are advised to keep an eye on market trends, economic factors, and company announcements that may influence future performance. With the ongoing advancements in technology and infrastructure, GTL Infra stands at an interesting crossroads in the rapidly evolving telecom landscape.