Current Trends and Factors Affecting SRF Share Price

Introduction

As one of India’s prominent players in the chemical and engineering sectors, SRF Limited has garnered significant attention from investors looking to capitalize on market trends. The analysis of SRF share price is crucial for both existing shareholders and those considering an investment. The stock has shown varying performance, reflecting broader market conditions and specific corporate developments.

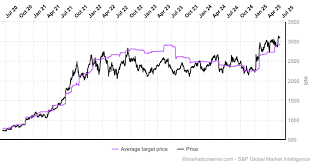

Current Share Price Trends

As of October 2023, SRF share price is trading around ₹2,500, showcasing a rise of approximately 15% over the past month. This increase can be attributed to a strong quarterly performance reported in September 2023, where the company posted a 20% year-on-year growth in revenue, driven primarily by its specialty chemicals and packaging films segments.

Market Influences

Several factors have impacted the share price. Firstly, the demand for SRF’s products, especially in the specialty chemicals sector, has surged, aided by India’s push for self-reliance in chemical production. The company’s strategic expansion into new markets and the development of sustainable products have also contributed to this positive outlook.

Secondly, the recent global economic recovery has played a role. As industries bounce back post-pandemic, SRF’s export potential increases, drawing investor interest. Moreover, the upcoming fiscal policies and incentives for the chemical sector outlined in India’s budget may further enhance investor sentiment.

Investor Sentiment and Forecasts

Analysts remain optimistic about SRF’s long-term growth trajectory. A report by SBI Research suggests that the share price could witness further gains, projecting a target of ₹3,000 by the end of the financial year, contingent upon continued performance and positive market conditions. However, potential investors are advised to consider market volatility and global economic factors that may influence share performance.

Conclusion

The SRF share price is on an upward trend, reflecting the company’s robust fundamentals and market potential. Investors are encouraged to monitor both domestic and global developments that could impact this trajectory. With ongoing growth in key sectors and strategic initiatives undertaken by the company, SRF presents a compelling case for those looking to invest in India’s thriving chemical industry.