Current Trends and Analysis of Tesla Stock

Introduction

Tesla Inc., a leading name in the electric vehicle market, has consistently been a focal point for investors and analysts alike, especially in the wake of rapidly evolving market dynamics. The relevance of Tesla stock, both as a barometer for the tech and green energy sectors, and as an investment vehicle, has amplified with the continued growth of electric vehicle adoption worldwide. Recent developments, including production shifts and changing market perceptions, have further influenced Tesla’s stock performance.

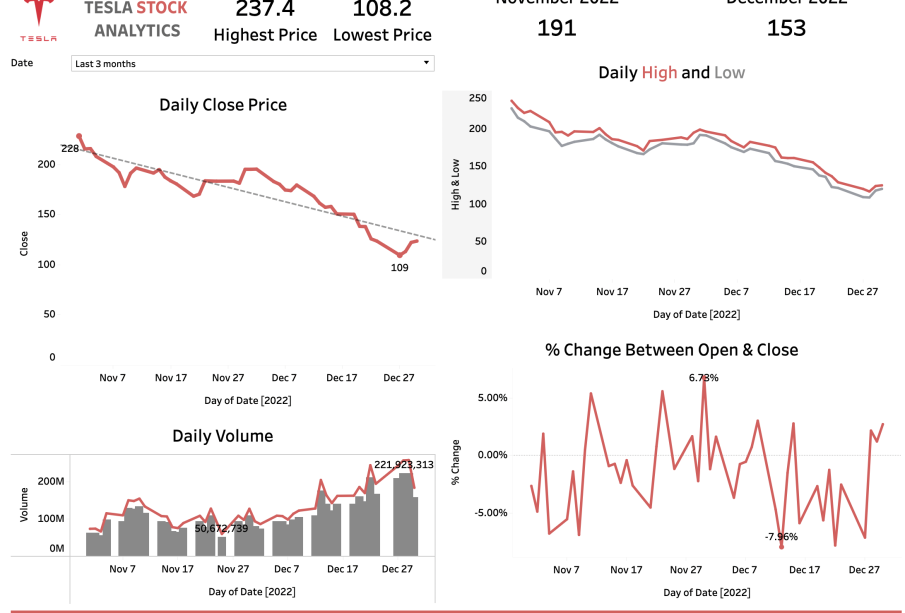

Recent Performance of Tesla Stock

In the past few months, Tesla’s stock has exhibited significant volatility, reflecting both concerns over macroeconomic factors and investor sentiment regarding electric vehicle manufacturers. As of October 2023, Tesla stock is trading around $250 per share, down from its all-time high of over $400 in late 2021. Recent earnings reports showed mixed results, driving fluctuations in stock price as analysts assess the company’s performance amidst increasing competition and global supply chain challenges.

Key Factors Impacting Tesla Stock

Several factors have critically impacted the performance of Tesla stock in recent months:

- Increased Competition: Traditional automakers and new entrants have intensified the race in the EV market, posing a threat to Tesla’s market share.

- Production Challenges: Ongoing supply chain issues and production delays have raised concerns about Tesla’s ability to meet increasing demand.

- Market Sentiment: Broader economic conditions, including interest rates and inflation, have affected investor confidence and stock attractiveness.

- Regulatory Concerns: Recent discussions around government regulations on EV subsidies in different countries also play a role in investor decisions.

Forecast and Significance

Looking ahead, the significance of Tesla stock remains robust as the global shift toward electric and sustainable vehicles continues. Analysts predict that as the company ramps up production capacity and mitigates supply chain issues, there could be potential for stock recovery. Moreover, Tesla’s ongoing innovations in battery technology and autonomous driving could contribute positively to its market position. Investors are advised to consider the long-term prospects of Tesla in line with broader market trends rather than short-term volatility.

Conclusion

In summary, Tesla stock continues to be an essential topic for investors, reflecting not just the health of the company but also broader trends in the automotive and tech industries. With varied influences shaping its trajectory, staying informed about Tesla’s performance is vital for anyone looking to navigate the stock market effectively.