Current Trends and Analysis of Ratan Power Share Price

Introduction

The share price of Ratan Power, a prominent player in the Indian power sector, has become a topic of keen interest among investors and market analysts alike. With the ongoing shifts in energy policies and the push towards renewable energy sources, understanding the nuances of Ratan Power’s stock performance is essential for anyone looking to invest in clean energy.

Recent Developments

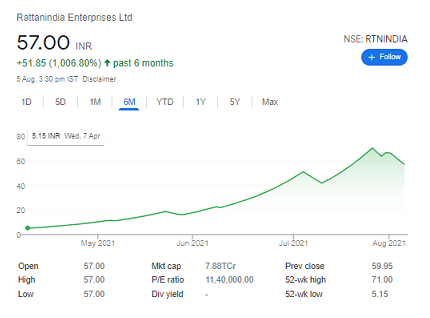

As of October 2023, Ratan Power’s share price has witnessed significant fluctuations. The stock opened at INR 150 and has seen a high of INR 165 and a low of INR 140 over the past month. Factors influencing these changes include quarterly earnings reports, government policies on energy tariffs, and global market trends that affect investor sentiment.

Market Factors

Recent announcements by the Indian government regarding financial incentives for renewable energy companies have positively impacted Ratan Power’s share price. Furthermore, the company’s efforts to transition towards solar energy production have positioned it favorably within the market. Analysts predict that if Ratan Power continues to innovate and improve operational efficiencies, its stock may strengthen further.

In a recent investment update, major brokerage firms have provided a target price for the stocks with an optimistic outlook. Analysts recommend the stock as a ‘Buy,’ suggesting that the current price levels present a good entry point for investors looking to capitalize on future growth.

Investor Sentiment

Overall investor sentiment surrounding Ratan Power has been cautiously optimistic. Institutional investors have been gradually increasing their stakes, which indicates confidence in the company’s long-term prospects. However, retail investors remain wary, often reacting to the volatility that has characterized the energy sector lately.

Conclusion

In conclusion, Ratan Power’s share price is influenced by a multitude of factors, from government policies to global energy trends. As the company aims to increase its footprint in the renewable energy market, investors should monitor its performance closely. With the ongoing transition to more sustainable energy sources in India, Ratan Power could be poised for significant growth in the coming years. Investors are advised to conduct thorough research and stay updated on the developments affecting the company before making investment decisions.