Current Trends and Analysis of Ola Share Price

Introduction

Ola, one of the leading ride-hailing platforms in India, has been making headlines recently, not just for its services but also for its performance in the stock market. Understanding the trends related to Ola share price is critical for investors and market analysts alike, given the rapid changes in the transportation industry and the company’s expansion plans. As Ola continues to grow, the impact on its share price becomes increasingly significant.

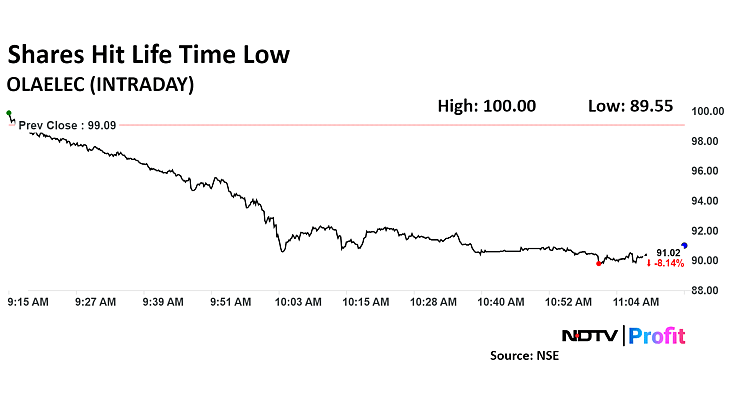

Recent Share Price Movements

In the past month, Ola’s share price has experienced notable fluctuations. As of the latest trading session, Ola shares were priced at approximately INR 950, marking a 12% increase from the previous month. Analysts attribute this rise to several factors, including the company’s successful launch of new services and expanding operations.

Factors Influencing Share Price

The key drivers behind the recent spike in Ola’s share price include:

- Expansion into New Markets: Ola has recently announced plans to expand its services beyond existing markets, focusing on international expansion which is expected to boost revenues.

- Investment in Electric Vehicles: Ola has heavily invested in electric mobility, aligning with government policies promoting sustainable transport, which has appealed to environmentally-conscious investors.

- Technological Innovations: Continuous improvements in app technology and user experience have also contributed to better customer satisfaction and, consequently, greater demand for services.

Market Sentiment and Predictions

Market sentiment regarding Ola remains generally positive, with investors optimistic about the company’s long-term prospects. Most financial analysts predict that if the company maintains its growth trajectory and successfully implements its expansion strategy, the share price could rise further in the coming quarters.

Conclusion

For both prospective investors and current stakeholders, keeping an eye on the fluctuations of the Ola share price is crucial for making informed decisions. With its growth strategy and focus on innovation, Ola is positioned to take advantage of the evolving market landscape. However, potential investors should also consider market risks and economic conditions that could affect share price movements in the future.