Current Trends and Analysis of Intel Share Price

Introduction

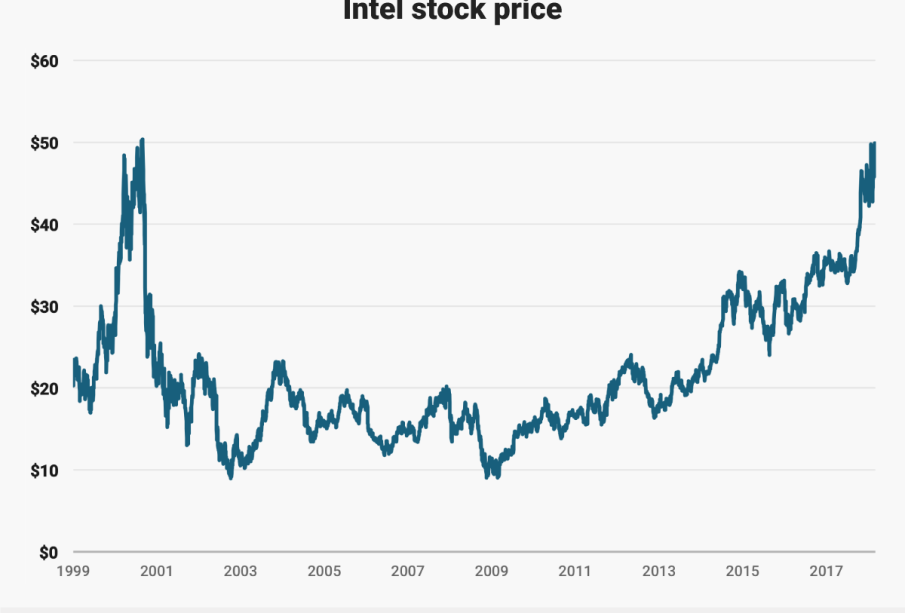

The share price of Intel Corporation has been a topic of interest for investors and analysts alike, especially in the wake of technological advancements and market shifts. As one of the leading semiconductor companies in the world, Intel’s performance is often seen as an indicator of the tech industry’s health. Understanding the fluctuations in Intel’s share price is essential for investors looking to make informed decisions in today’s volatile market.

Recent Performance

In the latter half of 2023, Intel’s stock has experienced significant volatility. As of October 23, 2023, Intel shares were trading at approximately $32.50, reflecting a steady increase from earlier in the year when shares dipped below $25. This rise can be attributed to several factors, including increased demand for chips fueled by the growth in artificial intelligence and high-performance computing. Recently, Intel announced new partnerships in the AI domain, signaling its commitment to remain competitive. Analysts have noted that this strategic pivot has positively impacted investor sentiment.

Market Influences

Various external factors have influenced Intel’s share price. The ongoing global semiconductor shortage has constrained supply chains, yet it has simultaneously driven up prices and demand, indirectly benefiting companies like Intel. Additionally, the company’s recent announcements regarding expansions in production capacity and investments in innovation have garnered positive media coverage, further enhancing investor confidence.

Moreover, geopolitical factors, including trade relations and policies affecting technology exports, are also critical. Intel has made strides to diversify its manufacturing, reducing reliance on specific regions, which analysts view as a proactive strategy.

Future Outlook

Looking ahead, analysts maintain a cautiously optimistic outlook for Intel’s share price. The global push towards digital transformation and an increasing focus on sustainable technology solutions are expected to create new avenues for growth. Market experts predict Intel could reach a target share price of around $40 by the end of 2024 if current trends continue, supported by robust product demand and successful implementation of their strategic initiatives.

Conclusion

In conclusion, the Intel share price is not just a reflection of the company’s performance but also a microcosm of broader market dynamics. Investors should monitor both internal developments and external market conditions closely. Understanding the underlying trends and forecasts related to Intel’s stock can provide valuable insights, helping investors make informed financial decisions in the fast-paced tech sector.