Current Trends and Analysis of GMDC Share Price

Introduction

In the ever-evolving landscape of the stock market, share prices are a significant indicator of a company’s performance and potential growth. Gujarat Mineral Development Corporation (GMDC), a prominent player in the mining and mineral sector in India, has been under the spotlight recently due to fluctuating share prices that reflect broader economic trends and the company’s operational developments. Understanding GMDC’s share price trajectory is crucial for investors looking to capitalize on market opportunities and assess long-term investments.

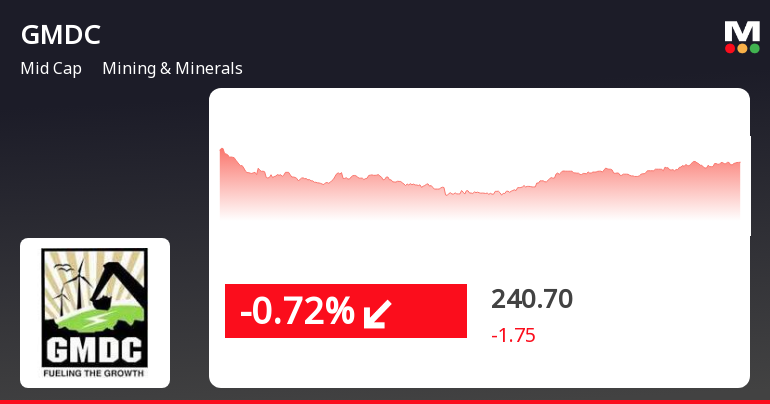

Recent Performance

As of October 2023, GMDC’s share price has seen notable volatility, influenced by a mix of market sentiments and underlying business factors. Over the past few months, GMDC shares have traded between INR 140 to INR 175, following trends in commodity prices, particularly in minerals like lignite and bauxite, which contribute significantly to GMDC’s revenue. The company recently reported a stable growth in quarterly earnings, bolstered by rising demand for minerals in various sectors such as construction and energy.

Market Sentiment and Factors Influencing price

Several factors have impacted GMDC’s share price in recent months. Analysts have noted the following:

- Commodity Prices: The fluctuating prices of minerals significantly affect revenue streams for GMDC, which in turn impacts its stock price.

- Government Policies: Regulatory changes and initiatives by the Gujarat state government aimed at promoting mining activities have resulted in increased investor interest.

- Market Trends: Broader market trends in the mining sector have contributed to investor sentiment, with many believing GMDC stands to benefit from long-term infrastructure development in India.

Investor Perspectives

Various investment analysts have provided optimistic reviews on GMDC’s potential, highlighting that long-term fundamentals remain strong despite short-term fluctuations. The emphasis on renewable energy projects and infrastructural growth in India could see GMDC positioned favorably over the next few years. However, investors also express caution, advising potential stakeholders to stay updated with global market trends and commodity price volatility.

Conclusion

The analysis of GMDC’s share price offers valuable insights for investors looking to navigate the complexities of the stock market. While recent performance indicates some volatility, market fundamentals suggest potential for growth driven by improving market conditions and resource demand. Investors are encouraged to evaluate market conditions and consider GMDC shares as a part of a diversified portfolio, remaining mindful of both the opportunities and risks inherent in the mining sector.