Current Status of ITC Hotel Share Price and Market Insights

Importance of Monitoring ITC Hotel Share Price

The stock market is a vital barometer of economic health and investor sentiment. The share prices of reputable companies like ITC Hotels, a part of the ITC Limited conglomerate, offer significant insights into the hospitality sector’s performance and investor confidence. Given the changing landscape of travel and tourism post-COVID-19, tracking the ITC Hotel share price is essential for both investors and stakeholders in the hospitality industry.

Current Trends in ITC Hotel Share Price

As of mid-October 2023, ITC Hotel shares have been showing a gradual increase. The share price currently stands at ₹380, demonstrating a steady rise of approximately 5% over the past month. This positive trend can be attributed to the revival of the hospitality sector as travel restrictions have eased, and domestic tourism has seen a significant uptick. Analysts suggest that ITC Hotels have been performing well, owing to their diversified portfolio and strong brand presence in the luxury hospitality space.

Factors Influencing ITC Hotel Share Price

Several factors play a crucial role in influencing the share price of ITC Hotels. Firstly, the resurgence of domestic travel and corporate events post-pandemic has led to a noticeable increase in occupancy rates across ITC properties. Secondly, the company’s strategic initiatives, including sustainable practices and technology adoption in service delivery, have enhanced customer experiences, thus driving demand.

Additionally, ITC Hotels is part of a larger ecosystem that includes the FMCG and tobacco sectors, which also contribute to its overall revenue. This diversified approach helps mitigate risks tied to the hospitality sector’s volatility. Current market analysts emphasize the importance of observing trends in consumer behavior and global economic conditions, which may affect both the tourism industry and ITC’s stock performance.

Future Projections and Investment Insights

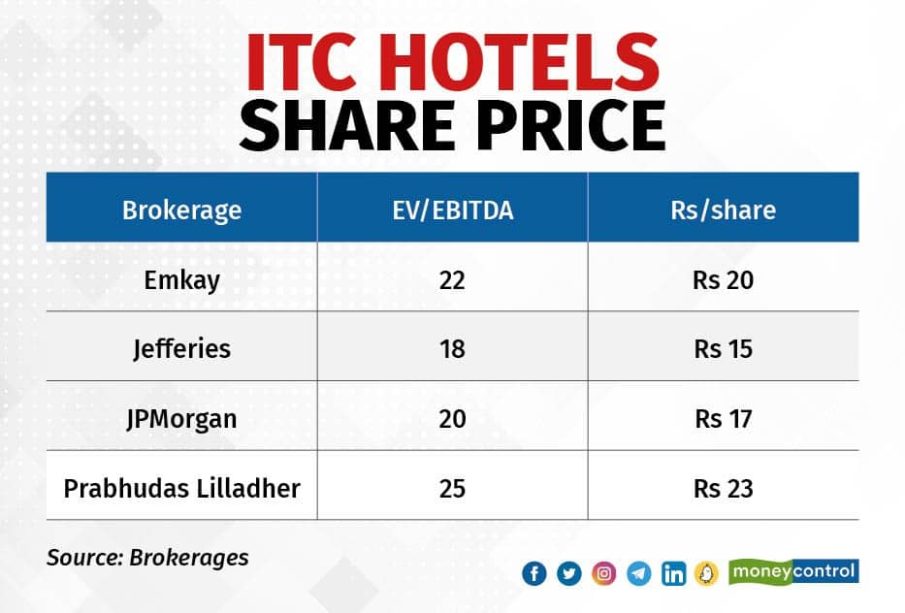

Looking ahead, market experts forecast a positive outlook for ITC Hotel share prices based on upcoming attractive investment opportunities within the Indian hospitality sector. As international tourism begins to bounce back, there could be further growth potential for hotels, especially those with a robust reputation like ITC. Potential investors are encouraged to conduct thorough research and consider market dynamics when making investment decisions.

Conclusion

In summary, the ITC Hotel share price remains a focal point for investors keen on the hospitality sector. The combination of favorable market conditions and the strategic efforts by ITC Hotels positions it well for future growth. Keeping an eye on market trends, company announcements, and industry developments will be key for stakeholders in the ever-evolving hospitality landscape.