Current Market Performance of IREDA Shares

Introduction

The Indian Renewable Energy Development Agency (IREDA) has gained significant attention among investors as a key player in the renewable energy sector. With India emphasizing sustainable energy sources, the performance of IREDA shares has become a focal point for market analysts and investors alike. Understanding the trends surrounding IREDA shares is essential, given the growing interest in green investments and the changing dynamics of the energy market.

Recent Developments

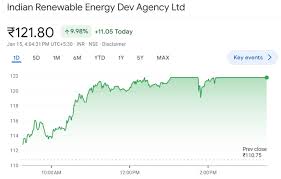

Recently, IREDA shares have shown a noticeable upward trend, partly thanks to the Indian government’s initiatives promoting solar and wind energy. As of October 2023, IREDA shares have increased by approximately 15% in value over the past month. Analysts attribute this growth to the increasing allocation of funds towards renewable projects and the agency’s strategic investments, aimed at maximizing returns and boosting energy output.

Moreover, the Government of India’s focus on achieving net-zero emissions by 2070 has created a favorable environment for companies like IREDA. This commitment has led to increased investments in the renewable sector, directly impacting the share prices positively. The International Energy Agency (IEA) has predicted a significant growth in renewable energy investments, further bolstering investor confidence in IREDA shares.

Market Sentiments

Investor sentiments towards IREDA shares have also been influenced by the overall performance of the renewable energy sector. The recently released quarterly earnings report indicated a steady increase in net profits, aligning with expert predictions and showcasing the agency’s robust financial health. Such reports tend to drive share prices upward, as they reflect the operational efficiency and growth potential of the company.

Market analysts are optimistic about the future of IREDA shares, citing several projects lined up for expansion and future funding aimed at renewable energy projects. However, they also caution investors about the volatility in the markets that could impact share prices based on global economic trends, policy changes, and competitive pressures from both domestic and international players.

Conclusion

The growth trajectory of IREDA shares underscores the increasing relevance of the renewable energy sector in India’s economic landscape. As investments continue to flow into this domain, stakeholders and investors are likely to keep a close watch on IREDA’s performance. With rising energy demands and a global move toward sustainability, IREDA shares are expected to remain a critical component of equity portfolios focused on green investments. In conclusion, while the current outlook for IREDA shares is optimistic, potential investors should remain vigilant and informed about market fluctuations impacting the renewable energy landscape.