Current Jiofin Share Price Trends and Market Analysis

Importance of Jiofin Share Price

The share price of Jiofin is a crucial indicator of its market performance and investor sentiment. Jiofin, a subsidiary of Reliance Industries, has gained prominence in the fintech sector, attracting significant interest from both retail and institutional investors. Understanding the trends in Jiofin’s share price can help investors make informed decisions.

Recent Performance and Trends

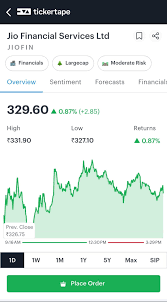

As of the latest trading session, Jiofin’s shares were priced at ₹680, reflecting a 2% increase from the previous week. The stock has shown remarkable resilience, rebounding from a low of ₹620 just a month ago. Analysts attribute this positive trend to the company’s robust financial performance and strategic expansions in digital banking services.

Jiofin’s market capitalisation currently stands at ₹80,000 crores, supported by a quarterly earnings report that showed a 25% growth in revenue compared to the same quarter last year. The company’s innovative approaches, including partnerships with leading tech firms and enhanced mobile payment solutions, have all positively influenced the share price.

Market Indicators and Future Outlook

The overall stock market has shown volatility due to economic policies and global trends, but Jiofin appears to be an outlier in this context. Support from its parent company, Reliance, combined with increasing adoption of digital finance solutions in India, suggests a strong performance outlook. Financial analysts recommend Jiofin as a buy, predicting its share price could reach ₹800 within the next quarter if the current growth trajectory continues.

Conclusion

For investors looking at Jiofin’s share price, it’s essential to monitor both the company’s performance indicators and broader market trends. With the ongoing shift towards digital finance and rising consumer trust in fintech solutions, Jiofin is well-positioned for sustained growth. Aspiring investors should keep an eye on the stock’s progress, as it could provide lucrative opportunities moving forward.