Current Insights on KRBL Share Price

Introduction

The share price of KRBL Limited, a leading player in the rice industry and one of the world’s largest exporters of Basmati rice, is a critical indicator for investors seeking insights into the agricultural and trading sectors. Understanding its valuation is important for making informed investment decisions, especially as the company navigates evolving market dynamics, including export demand and domestic production challenges.

Recent Performance

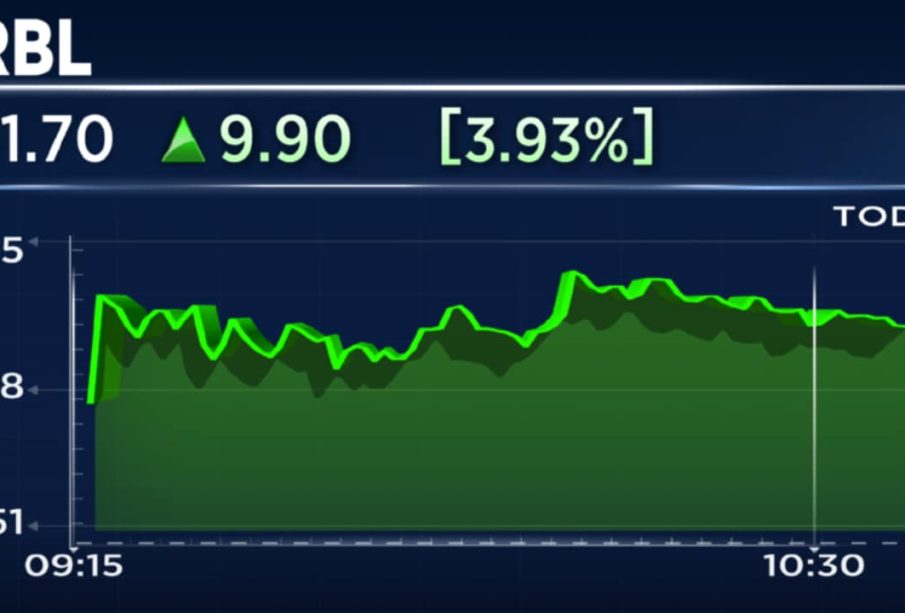

As of [insert date], KRBL’s share price has shown significant fluctuations, influenced by both local market conditions and global commodity trends. The stock closed at [insert price] on [insert date], reflecting an increase of [insert percentage] from the previous session. Recent reports indicate that the company has benefited from increased demand for Basmati rice, particularly following strong export orders from international markets.

Market Factors

Several key factors have contributed to the recent movements in the KRBL share price:

- Rising Export Demand: As countries seek quality Basmati rice, KRBL has secured contracts that are expected to boost its revenue.

- Government Policies: The Indian government’s initiatives aimed at supporting agriculture have positively impacted farmers and, in turn, companies like KRBL.

- Supply Chain Dynamics: The management of supply chains and agricultural production, especially in light of weather fluctuations, remains pivotal for KRBL’s profitability.

Future Outlook

Analysts forecast a strong outlook for KRBL in the upcoming quarters, driven by robust demand both domestically and internationally. The share price is anticipated to stabilize around [insert projected price], assuming no significant disruptions in global markets or supply chains. Investors are advised to keep an eye on quarterly earnings reports and market analysis to gauge prospects accurately.

Conclusion

The KRBL share price serves as a barometer of the company’s performance and the broader agricultural sector’s health. With favorable market conditions and strategic leadership, KRBL appears poised for growth, making it a noteworthy consideration for potential investors focusing on the agricultural export segment.