Current Insights on ICICI Bank Share Price

Introduction

ICICI Bank, one of India’s leading private sector banks, has been in the spotlight lately due to fluctuations in its share price. As a barometer for investor confidence and economic health in the banking sector, understanding the current trends in ICICI Bank’s share price is critical for shareholders and potential investors.

Current Share Price Trends

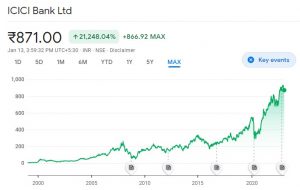

As of mid-October 2023, ICICI Bank shares are trading at approximately ₹930, having seen a notable increase of around 15% over the past month. This surge is attributed to robust quarterly results, with a net profit increase of 20% year on year, signaling strong loan growth and improved asset quality. Analysts are optimistic, projecting ICICI Bank’s share price to potentially reach ₹1,000 in the following month, given current market conditions.

Factors Impacting the Share Price

Several factors have contributed to the recent rise in ICICI Bank’s share price. The ongoing economic recovery post-pandemic, coupled with the Reserve Bank of India’s accommodative monetary policy, has created a conducive environment for banks. Moreover, ICICI Bank’s focus on digital banking services has attracted a younger customer base, enhancing customer engagement and driving deposits.

Additionally, the bank’s strong capital adequacy ratio stands at 17%, providing a solid cushion against economic uncertainties. Institutional investors have also shown increasing interest, further buoying share prices amid optimistic market sentiment.

Market Predictions

Experts suggest that the positive momentum in the stock is expected to continue as long as the bank maintains its performance. Short-term investors are advised to keep a close eye on quarterly results and economic indicators that could influence market sentiment. Analysts predict that if ICICI Bank can sustain its growth trajectory, share prices might even cross the ₹1,050 mark in the next two to three quarters.

Conclusion

The fluctuations and current performance of ICICI Bank’s share price reflect broader trends in the Indian banking industry and the overall economy. For investors, staying informed about financial results, market conditions, and economic policies will be crucial in making investment decisions. The ongoing digital transformations and strong financial health of ICICI Bank position it well for future successes, suggesting optimism in its share price movements going forward.