Current Insights on Bharat Forge Share Price Trends

Introduction

The share price of Bharat Forge, a leading Indian multinational company in the forge sector, is vital for investors and market analysts. Understanding its price movements is crucial for making informed investment decisions, particularly due to the company’s significant role in the automotive and defence industries. As of recent reports, Bharat Forge’s share price has experienced notable fluctuations influenced by global economic conditions and industry-specific developments.

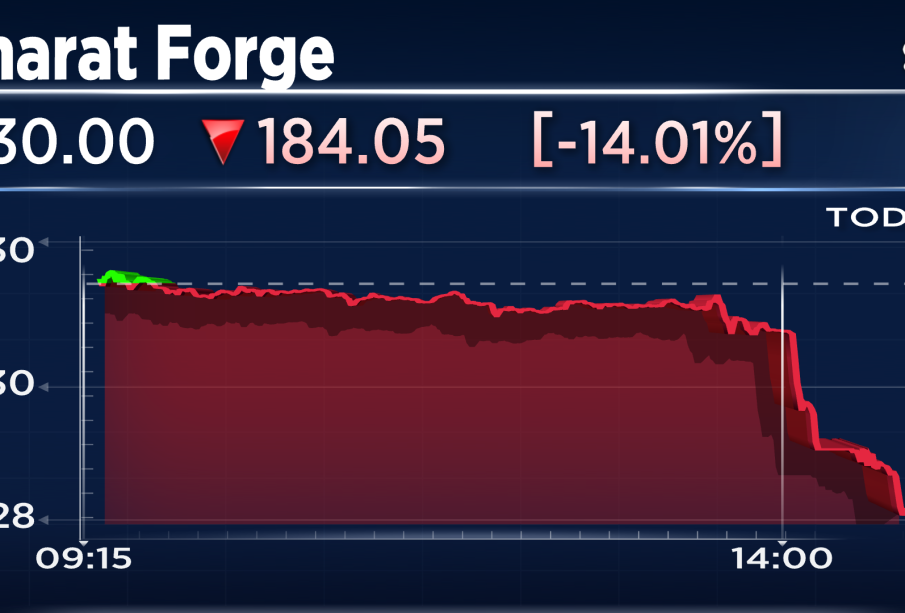

Recent Performance

As of October 2023, Bharat Forge’s shares have shown resilience amidst market volatility. The stock has been fluctuating around ₹773 per share. Over the last month, the share price has appreciated by approximately 5%, recovering from earlier dips attributed to global supply chain challenges and inflationary pressures that impacted the automotive sector. Analysts attribute this uptick to robust demand in both domestic and international markets, especially following recent government initiatives aimed at boosting manufacturing.

Factors Influencing Share Price

Several factors have been influencing Bharat Forge’s share price recently:

- Financial Performance: The company reported a 22% year-on-year growth in revenues in its latest quarterly result, a positive indicator for investors.

- Global Partnerships: New collaborations with foreign defense firms to manufacture key components have bolstered investor confidence.

- Market Trends: A surge in electric vehicle production and a general recovery in the automotive sector have positively impacted the demand for forged products.

- Economic Indicators: Improved economic indicators such as manufacturing growth are further supporting the stock’s upward trajectory.

Conclusion

Overall, the share price of Bharat Forge remains a key point of interest for investors looking for long-term growth opportunities in the evolving manufacturing landscape. Given the company’s strategic focus on expanding its product range and entering new market segments, analysts forecast potentially higher valuations in the forthcoming quarters. Stakeholders are advised to monitor economic trends and company announcements closely to make informed investment decisions. The future performance of Bharat Forge’s stock will likely correlate with broader economic recovery and sectoral growth in India.