Current DMart Share Price Analysis and Trends

Introduction

The DMart share price is a crucial indicator for investors looking to understand the performance of Avenue Supermarts Ltd, known for its popular retail chain D Mart in India. As one of the leading players in the Indian organized retail sector, tracking the fluctuations in its share price can give insights into market sentiment towards this growing industry.

Recent Trends

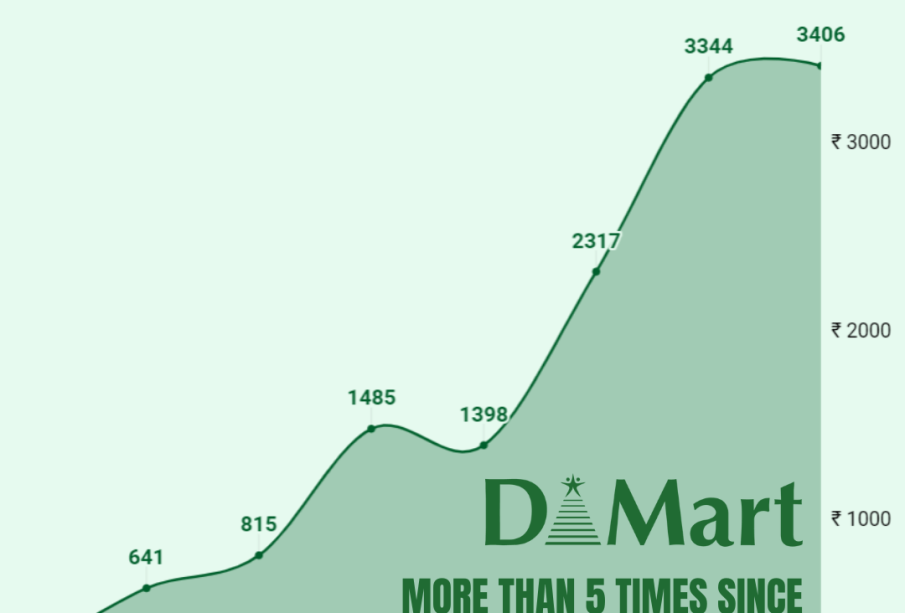

As of October 2023, DMart’s share price has shown a significant trend, indicating fluctuations influenced by various market dynamics and economic factors. On October 20, 2023, the share price opened at INR 4,120 per share, showing a slight increase compared to the previous week. Analysts attribute this growth to increased footfall in stores and strong quarterly earnings reports that surpassed market expectations.

Factors Influencing the Share Price

Several factors have impacted DMart’s share price in recent months. Firstly, the expansion of new store openings has helped boost revenue, with the company planning to add more outlets in untapped areas across the country. Secondly, the overall growth of the retail sector post-pandemic has led to higher consumer spending, benefitting DMart’s bottom line.

Moreover, DMart’s focus on maintaining low prices has continued to attract budget-conscious shoppers, which has solidified its market presence even in challenging economic conditions. The company’s e-commerce initiatives also show potential for future growth, aiming to capture a larger market share as online shopping becomes more prevalent.

Investment Outlook

Market analysts remain generally positive about DMart’s future growth prospects. Some suggest that as e-commerce trends continue to rise, the company’s investment in integrating online and offline shopping experiences could result in a significant upside. However, potential investors should also be cautious, as retail is sensitive to fluctuating consumer behavior and economic uncertainties.

Conclusion

In summary, the DMart share price remains a prominent investment marker in the Indian retail landscape. With strong performance indicators and strategic growth plans, Avenue Supermarts Ltd seems poised to maintain a flourishing trajectory. As always, investors should conduct thorough research and consider market trends before making investment decisions related to DMart shares. With upcoming financial results and further market analysis, the landscape for DMart shares promises to keep both investors and analysts engaged.