Current Analysis of Eternal Share Price

Introduction

The share price of Eternal, a prominent player in the renewable energy sector, has garnered significant attention from investors and market analysts alike. As global policies increasingly favor sustainable energy solutions, understanding the factors influencing Eternal’s share price is critical for potential investors. This article delves into the recent fluctuations in Eternal’s stock values, the market sentiment surrounding the company, and the broader implications for investors.

Recent Trends in Eternal Share Price

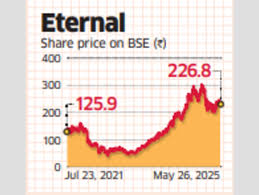

As of October 2023, Eternal’s share price has experienced notable volatility, largely spurred by external market conditions and internal corporate developments. The stock saw a 15% increase over the past month, attributed to announcements regarding innovative energy solutions and partnerships with key governmental bodies. In contrast, uncertainties surrounding regulatory changes in the renewable sector briefly dampened investor enthusiasm, causing fluctuations in share value.

Factors Influencing the Share Price

Several key factors are influencing the current state of Eternal’s share price:

- Market Demand for Renewable Energy: The global shift towards renewable energy solutions has amplified interest in companies like Eternal. Analysts predict continued growth in the sector, directly affecting stock performance.

- Company Innovations: Recent product developments and innovations in solar technology have positioned Eternal as a leader in the renewable industry, further increasing investor confidence.

- Regulatory Impacts: Changes in government policies regarding renewable energy incentives and tariffs can cause immediate reactions in the stock market, including fluctuations in Eternal’s share price.

- Competitor Movements: Rival companies are continuously innovating and expanding their market presence, which can impact investor sentiment towards Eternal.

Conclusion

The future of Eternal’s share price remains a topic of keen interest among investors. As the renewable energy sector expands, several analysts forecast that the company’s share price will see further growth, especially if it maintains its innovative edge and continues to respond adeptly to market trends. Investors are advised to stay informed of regulatory changes and company announcements that could influence share price movements. By monitoring these developments, stakeholders can make more informed investment decisions in a rapidly evolving market landscape.