Crude Oil Prices: Current Trends and Implications

Introduction

Crude oil prices are a crucial component of the global economy, impacting everything from fuel costs to inflation rates. As of late 2023, crude oil prices have seen significant volatility driven by geopolitical tensions, changing supply dynamics, and shifts in demand. Understanding these fluctuations and their broader implications is essential for consumers, businesses, and policymakers alike.

Current Trends in Crude Oil Prices

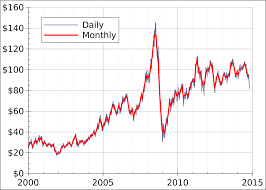

As of October 2023, crude oil prices have experienced a marked increase, reaching approximately $90 per barrel. This surge can be attributed to several factors, including ongoing conflicts in oil-rich regions, cuts in production by major oil-exporting nations, and a recovering global demand post-COVID-19. Notably, OPEC+ has recently agreed to implement further production cuts, aiming to stabilize prices amid concerns of oversupply in a volatile market.

Geopolitical Factors at Play

The ongoing tensions between major oil producers and consumer nations have exacerbated uncertainty in the crude oil market. Conflicts in the Middle East, particularly the situation surrounding Iran and Saudi Arabia, have raised fears of potential supply disruptions. Additionally, sanctions on Russia continue to impact global oil flows, influencing market perceptions and driving prices upward. Market analysts suggest that these factors could sustain high price levels in the short term.

Impact on Global Economy

The implications of rising crude oil prices are multifaceted. Higher oil prices typically translate into increased transportation and production costs across various sectors, leading to higher consumer prices and potential inflationary pressures. For emerging economies that rely heavily on oil imports, this trend could strain economic growth and lead to trade imbalances.

Future Outlook

Looking forward, analysts predict that crude oil prices could remain elevated through the end of 2023 and into 2024, contingent upon geopolitical developments and global economic recovery trends. While some forecasts suggest a easing of prices as supply constraints are addressed, others warn of persistent volatility driven by ongoing geopolitical risks. Stakeholders in the energy market must stay vigilant and responsive to these dynamics to navigate the changing landscape.

Conclusion

In conclusion, crude oil prices play a pivotal role in the functionality of the global economy. Given the current geopolitical context and emerging market trends, the volatility of crude oil prices continues to be a critical area for observation. Consumers and businesses alike should prepare for potential fluctuations, considering both short-term and long-term strategies to mitigate the impacts of these price changes.