Crude Oil Inventory: Current Trends and Implications

Understanding Crude Oil Inventory

Crude oil inventory levels are a pivotal aspect of the global energy market, influencing pricing, production decisions, and economic stability. As nations continue to navigate recovery from the pandemic and geopolitical tensions persist, the state of crude oil inventories receives heightened scrutiny from investors, analysts, and policymakers alike.

Current Trends in Crude Oil Inventory

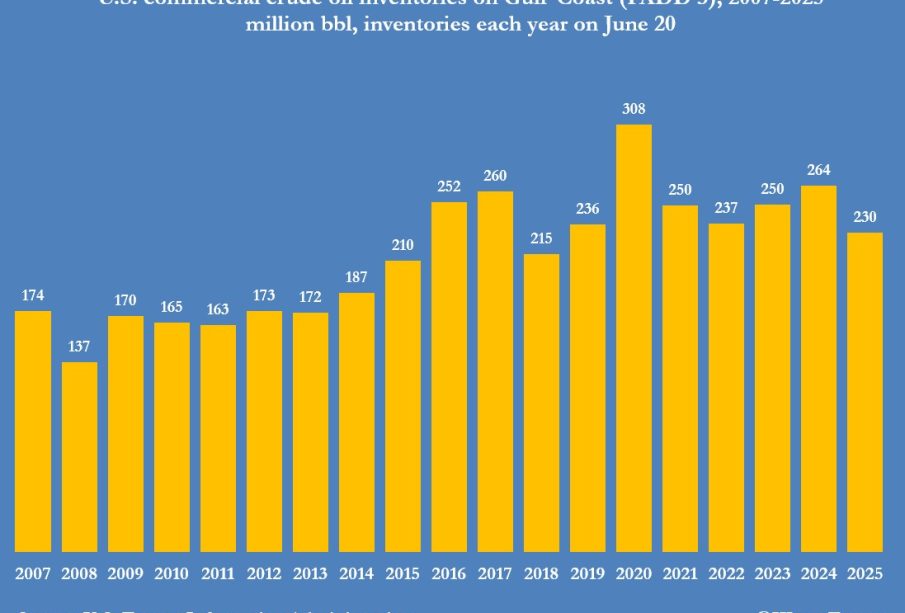

According to the latest data released by the U.S. Energy Information Administration (EIA), crude oil inventories in the United States rose by 3.3 million barrels during the last week of October 2023. This increase brings the total commercial crude oil inventory to 467.2 million barrels, significantly above the five-year average. The rise in inventory can be attributed to robust domestic production and stagnation in demand due to economic uncertainty and seasonal fluctuations.

Notably, analysts had initially predicted a decline in crude oil stockpiles, emphasizing the unpredictability of market dynamics. A key factor in these developments is the ongoing impact of OPEC+ production cuts aimed at stabilizing prices in a volatile global market.

Global Context and Implications

Globally, crude oil inventories have maintained high levels, particularly in the U.S., while other regions also reflect varying trends. Countries in Europe are experiencing heightened demand amid an energy crisis exacerbated by geopolitical tensions, primarily surrounding the ongoing conflict in Eastern Europe. In contrast, Asia-Pacific markets are showing mixed signs, with countries like India ramping up imports and consumption while grappling with inflationary pressures.

The fluctuating inventories underline the delicate balance between supply and demand. With the upcoming winter months, demand is expected to spike; however, concerns regarding economic growth and potential recession could dampen consumption rates across major economies.

Future Outlook for Crude Oil Inventories

Looking ahead, industry experts anticipate that crude oil inventories will continue to be influenced by several factors, including geopolitical issues, climate policies, and technological advancements in energy production. The shift towards renewable resources is expected to shape long-term inventory trends and consumption patterns.

In conclusion, the current state of crude oil inventories is a vital indicator of market health and investor sentiment. Understanding these trends can provide valuable insights into future price movements and economic stability. As the global energy landscape continues to evolve, staying informed about these developments is crucial for stakeholders across the energy sector.