Chandi Price: Latest Trends and Market Insights

Introduction

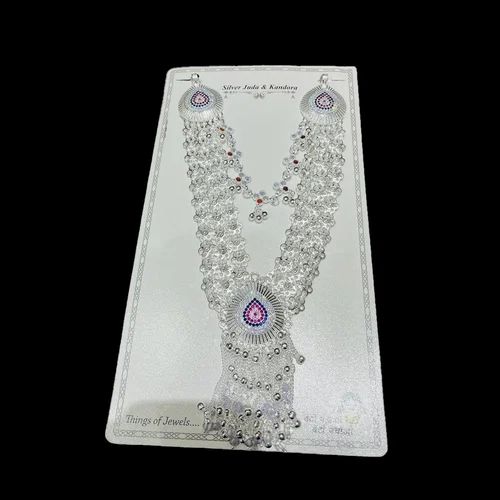

Chandi, or silver, has always held a significant place in Indian culture and economy. Its various uses in jewelry making, investment, and industry make it a crucial commodity. As we navigate through 2023, understanding the current trends and pricing of chandi is essential for consumers, investors, and industry stakeholders alike.

Current Prices and Market Analysis

As of October 2023, the price of chandi in India has been fluctuating due to various factors, including global silver prices, demand from the jewelry sector, and economic policies. The price per kilogram of silver has been hovering around ₹75,000, influenced by a mix of international demand, mining costs, and market speculation.

In recent months, silver has gained traction among investors as a hedge against inflation. This shift is partially due to increasing economic uncertainties and fluctuating stock markets, which have led many to diversify their portfolios. Furthermore, the festive season approaching in India traditionally boosts demand for silver jewelry, particularly among rural and urban consumers alike.

Global Factors Impacting Chandi Prices

Globally, several factors contribute to the chandi price trends. The ongoing industrial demand for silver, notably in electronics and solar energy, is a significant driver. Additionally, geopolitical tensions and shifts in monetary policy by central banks worldwide can lead to price volatility.

China remains one of the largest consumers of silver for both industrial purposes and investment. Any changes in production or demand from the Chinese market can heavily influence prices globally. Moreover, the transition towards renewable energy sources is expected to increase silver demand as the metal is critical in technologies like solar panels.

Future Forecasts

Analysts predict that the price of chandi may see further fluctuations due to various impending economic factors. The upcoming festive season may provide a temporary uplift in prices, but long-term forecasts are cautiously optimistic, focusing on the interplay of industrial demand and investment strategies. Investors are advised to keep an eye on the global market trends and local demand patterns.

Conclusion

In conclusion, staying informed about chandi prices is vital for anyone involved in its trade or investment. With the market influenced by global trends and local demands, understanding these dynamics can help consumers make better decisions. As we move forward in 2023, keeping abreast of the changes in chandi prices will remain essential for maximizing investments and understanding market sentiment.