CBDT Circular Audit Report Extension: What You Need to Know

Introduction

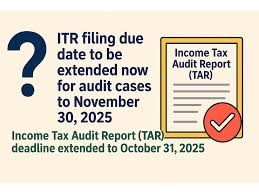

The Central Board of Direct Taxes (CBDT) recently issued a circular announcing an extension of the deadline for certain audit reports. This move comes at a crucial time as businesses and taxpayers navigate the complexities of tax compliance amidst ongoing economic challenges. Understanding the significance of this extension is vital for chartered accountants, businesses, and taxpayers alike, as it impacts filing requirements and potential audits.

Details of the CBDT Circular

On October 15, 2023, the CBDT circular provided an extension for the submission of audit reports related to income tax returns for the financial year 2022-2023. The original deadline was set for October 31, 2023, but the new deadline has been pushed to November 30, 2023. This decision has been welcomed by many stakeholders, including chartered accountants, who often face time constraints in gathering the necessary documentation and conducting thorough audits.

Reasons Behind the Extension

The CBDT cited several reasons for extending the deadline, including disruptions caused by recent economic conditions and the need for taxpayers to be accurately represented in their tax filings. Additionally, the move aims to reduce the backlog of pending cases and ensure that taxpayers can meet compliance requirements without incurring penalties. This extension is expected to ease the pressure on businesses, especially small and medium-sized enterprises (SMEs) that may require additional time to complete the auditing process.

Implications for Taxpayers

For taxpayers, this extension means they will have more time to prepare their financial statements, ensuring accuracy and compliance with tax laws. It is an opportunity for businesses to review their financial health and rectify any discrepancies before filing. However, stakeholders are advised to take this extension seriously and ensure timely submission to avoid penalties or interest charges that may arise from delayed filings.

Conclusion

The CBDT’s decision to extend the audit report deadlines signals a commitment to support taxpayers in fulfilling their responsibilities, particularly during challenging economic times. As businesses take advantage of this extra time, it is crucial to remain proactive in understanding the implications of this extension for future tax compliance. Taxpayers are encouraged to work closely with their accountants to ensure that they meet the revised deadlines and take necessary measures to maintain compliance with the tax regulations.