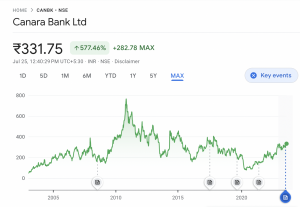

Canara Bank Share Price Trends and Analysis

Introduction

Canara Bank, one of India’s leading public sector banks, has been attracting significant attention from investors due to its resilient performance and potential for growth. With recent fluctuations in the stock market, understanding its share price is essential for both current and prospective stakeholders. Tracking the Canara Bank share price can provide essential insights into the bank’s financial health and broader market trends, making it a crucial topic for investment decisions.

Current Share Price Performance

As of October 2023, Canara Bank’s share price stands at approximately ₹352. The bank’s stock has shown considerable volatility in recent months, with highs reaching around ₹380 and lows nearing ₹300. The fluctuations can be attributed to a mix of factors including macroeconomic indicators, regulatory changes, and performance metrics from the bank itself.

Factors Influencing Share Price

Several factors influence the share price of Canara Bank, including:

- Financial Performance: Canara Bank recently reported a robust quarterly earnings growth, with net profit increasing by 30% year-on-year. This growth has positively impacted investor confidence.

- Market Sentiment: Global economic conditions, including inflation and interest rates, have a direct impact on investor behavior and, subsequently, on share prices.

- Government Policies: Being a public sector bank, Canara is influenced by government policies aimed at improving the banking sector. Announcements related to banking reforms or incentives can lead to fluctuations in its share price.

Future Outlook

Analysts project a cautiously optimistic outlook for Canara Bank. Long-term trends suggest steady growth momentum, particularly with increasing credit demand and improving asset quality. However, the bank faces challenges such as rising non-performing assets (NPAs) and potential interest rate hikes, which could impact profitability.

Conclusion

Investors should closely monitor Canara Bank’s share price, keeping an eye on economic signals and the bank’s quarterly performance reports. The current trading range presents opportunities for entry for discerning investors. With a strong foundation and proactive management, Canara Bank remains a significant player in the banking sector, promising potential growth in the coming years. By staying informed and analyzing trends, investors can make well-rounded decisions tailored to their financial strategies.