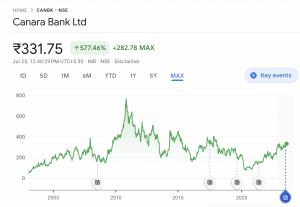

Canara Bank Share: Current Performance and Future Outlook

Introduction

Canara Bank, one of India’s largest public sector banks, has been a significant player in the Indian banking sector since its establishment in 1906. The bank’s shares are closely watched by investors, as they reflect not only the bank’s performance but also broader economic trends. Recent movements in the banking sector make it crucial to analyze Canara Bank’s share performance in context.

Current Performance

As of October 2023, Canara Bank shares have shown a positive trajectory, climbing by approximately 15% over the past six months. The share price has been buoyed by the bank’s strong quarterly results, which reported a net profit increase of 30% year-on-year, driven by improved asset quality and lower provisioning for bad loans. Additionally, Canara Bank’s capital adequacy ratio stands at a comfortable 16%, ensuring that it has enough capital to absorb potential losses and support business growth.

Recent Developments

In recent months, Canara Bank has undertaken several strategic initiatives aimed at boosting growth. The launch of new digital banking services has attracted younger customers, contributing to an increase in the bank’s overall digital transactions. Furthermore, the bank has expanded its coverage in rural areas, a move aligned with the government’s push for financial inclusion. Analysts believe that these efforts will bolster Canara Bank’s customer base and enhance profitability in the long term.

Market Sentiment and Expert Opinions

Market analysts have a mixed outlook on Canara Bank shares for the foreseeable future. Some experts forecast that, with continued growth in retail loans and a recovering economy, the share could witness further appreciation. Others urge caution, highlighting potential challenges such as increased competition from private banks and the impact of global economic uncertainty on local business. The consensus, however, remains optimistic, especially for investors looking for long-term growth.

Conclusion

Investing in Canara Bank shares could be a sound decision given the bank’s solid fundamentals and robust growth strategies. As the financial sector evolves, the bank’s adaptability could play a crucial role in sustaining its market position. For investors, keeping an eye on the bank’s quarterly performance reports and understanding broader economic indicators will be essential for informed decision-making. Overall, Canara Bank shares not only contribute to investors’ portfolios but also reflect the health of the Indian banking landscape.