BHEL Share Price: Current Status and Market Insights

Introduction to BHEL Shares

Bharat Heavy Electricals Limited (BHEL) holds a significant position in India’s manufacturing sector, primarily focusing on power generation equipment. As a Public Sector Undertaking (PSU) under the Ministry of Heavy Industries and Public Enterprises, BHEL’s stock plays a vital role in the stock market, not just as an investment option but also as a barometer for the country’s industrial growth. Therefore, monitoring BHEL share price trends is crucial for investors, stakeholders, and industry analysts.

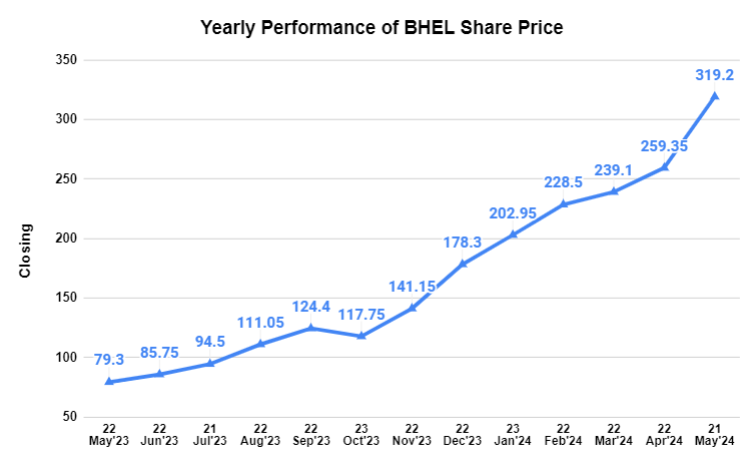

Current Market Performance

As of the latest reports, BHEL share price has shown a noticeable increase over the past month, trading at approximately ₹70 per share. This represents a rise of around 10% from its previous month’s average. This increase is attributed to several factors including government initiatives to boost infrastructure, ongoing projects in renewable energy, and positive quarterly results showcasing improved profit margins.

Factors Influencing BHEL Share Price

The recent bidding wins for various power projects have significantly contributed to the optimistic outlook surrounding BHEL shares. The company has secured contracts under the National Infrastructure Pipeline, which aligns with the government’s focus on enhancing power generation capacities. Additionally, the surge in renewable energy investments, particularly solar and hydroelectric projects, is expected to bolster BHEL’s earnings further.

Moreover, macroeconomic factors such as decreasing interest rates and a favorable inflation outlook have positively impacted investor sentiment towards BHEL shares. Analysts believe that these trends will continue to support a stable increase in share price, especially with the anticipation of increased power demand in the upcoming year.

Future Outlook

Looking ahead, analysts suggest that BHEL share price may witness further volatility due to global economic conditions and domestic policy changes. Investors are encouraged to keep a close eye on quarterly earnings reports and government announcements regarding infrastructure spending. Long-term growth prospects remain promising, especially if BHEL continues to innovate and adapt to the rapidly changing energy sector landscape.

Conclusion

In conclusion, BHEL share price remains a focal point for investors keen on participating in India’s industrial growth. With its ongoing projects and state support, BHEL is likely to grow, making it a significant player in the energy sector. Investors should conduct thorough research and remain updated on market trends to make informed decisions concerning BHEL shares in the coming weeks.