Bharti Airtel Share: Current Performance and Future Outlook

Introduction

The landscape of telecommunications in India is rapidly evolving, with Bharti Airtel standing at the forefront. As one of the leading telecom operators in the country, understanding the performance of Bharti Airtel’s shares is crucial for investors seeking to navigate the complexities of the stock market. As of October 2023, the share price of Bharti Airtel has been a focal point for both retail and institutional investors, given its implications for the broader market trends in the telecom sector.

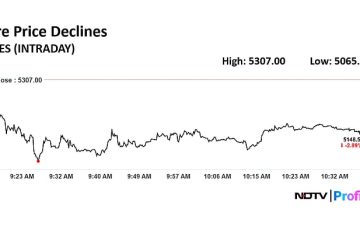

Current Performance of Bharti Airtel Shares

Bharti Airtel’s shares have witnessed significant fluctuations in recent months. Starting the month of October at around ₹800 per share, their value has been influenced by various factors, including competition from newer entrants, regulatory changes, and overall economic conditions. Due to the increasing demand for data services and the rollout of 5G technology, analysts expect a positive trajectory for the company.

Recent financial reports have shown Bharti Airtel maintaining a steady growth rate, with a marked increase in both subscriber base and revenue. The company reported a net profit increase of 30% in the last quarter, driving investor confidence and contributing to a rally in its stock price. Furthermore, continuous investment in infrastructure and services has enhanced its market position, allowing it to fend off competition effectively.

Recent Developments

In recent news, Bharti Airtel announced plans to significantly invest in its network infrastructure, pledging ₹20,000 crores over the next five years to improve connectivity and enhance service quality. This announcement, along with the anticipation of 5G deployment, is expected to further bolster its market position. Additionally, Airtel’s recent partnerships with global technology firms for advancement in digital solutions highlight its commitment to innovation.

Conclusion and Future Outlook

With various strategic initiatives in place and a focus on expanding its service offerings, Bharti Airtel’s shares are likely to remain a topic of interest for investors. Analysts predict continued growth in the telecom sector, driven by increasing data consumption and the rollout of advanced technologies. While market volatility is a natural element to consider, the outlook for Bharti Airtel shares in the coming quarters appears optimistic.

Investors are advised to keep a close watch on market developments, financial reports, and policy changes that may impact Bharti Airtel’s performance. Staying informed and making data-driven decisions will be crucial in navigating the dynamic telecom market effectively.