Bank of India Share Price: Latest Trends and Insights

Introduction

The Bank of India (BOI) has been a significant player in the Indian banking sector, offering a wide range of financial services. Its share price movements are closely watched by investors and analysts alike as they can indicate the bank’s performance and general market sentiment. Understanding the fluctuations in the Bank of India share price is crucial not only for potential investors but also for those interested in the overall health of the banking sector in India.

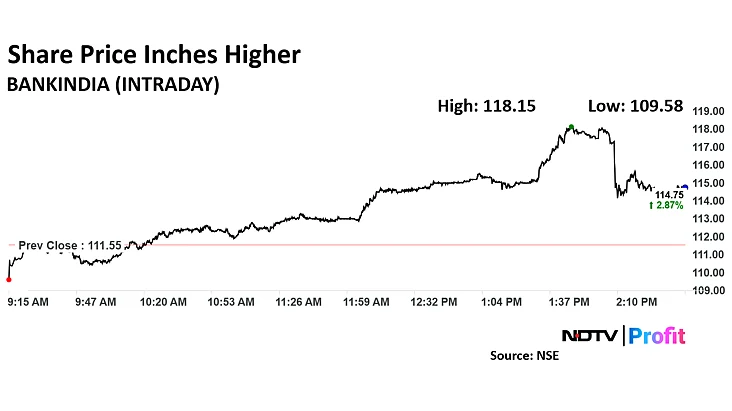

Current Share Price Trends

As of October 2023, the Bank of India share price has shown considerable resilience amid the fluctuating Indian stock market. Currently, the share price is hovering around ₹76 per share, reflecting a steady increase of approximately 4% over the past month. Analysts attribute this positive trend to several factors, including improved asset quality and a reduction in non-performing assets (NPAs). In the latest quarterly report, Bank of India reported a net profit of ₹1,050 crores, a significant increase compared to the previous year, which has positively impacted investor sentiment.

Market Factors Influencing Share Price

Several macroeconomic factors are contributing to the Bank of India’s share price performance. The Reserve Bank of India’s (RBI) recent decision to maintain a stable interest rate has encouraged borrowing and investment, directly benefiting banks. Additionally, an uptick in economic activity post-pandemic, particularly in sectors like manufacturing and services, has resulted in increased lending opportunities for banks. Investors are optimistic that the government’s reforms focusing on the banking sector will lead to sustained growth.

Investment Recommendations

Experts suggest that investors consider the Bank of India as a moderate risk investment, especially for those looking to diversify their portfolios with banking stocks. Key analysts recommend a hold strategy for existing investors, while advising potential investors to closely monitor the share price for any significant dips which could provide a buying opportunity at lower valuations. Given the projected growth in the Indian economy and the bank’s strategic initiatives, the outlook appears favorable.

Conclusion

The Bank of India share price remains a critical indicator of both the bank’s operational health and the functioning of the banking sector at large. As the bank continues to manage its NPAs effectively and capitalize on growth opportunities, investors can anticipate a positive trajectory in the share price. Staying informed about market conditions and regulatory changes will be essential for anyone looking to invest in Bank of India shares. Overall, the future looks promising, and as such, keeping an eye on the performance of Bank of India in the coming months will be crucial for stakeholders.