Axis Bank Share Price: Current Trends and Insights

Introduction

Axis Bank, one of India’s leading private sector banks, plays a crucial role in the financial landscape of the country. With its extensive range of services and growing customer base, the bank’s share price is a vital indicator for investors and market analysts. Understanding the dynamics of Axis Bank’s share price is important for those looking to make informed investment decisions in the current economic climate.

Current Share Price Trends

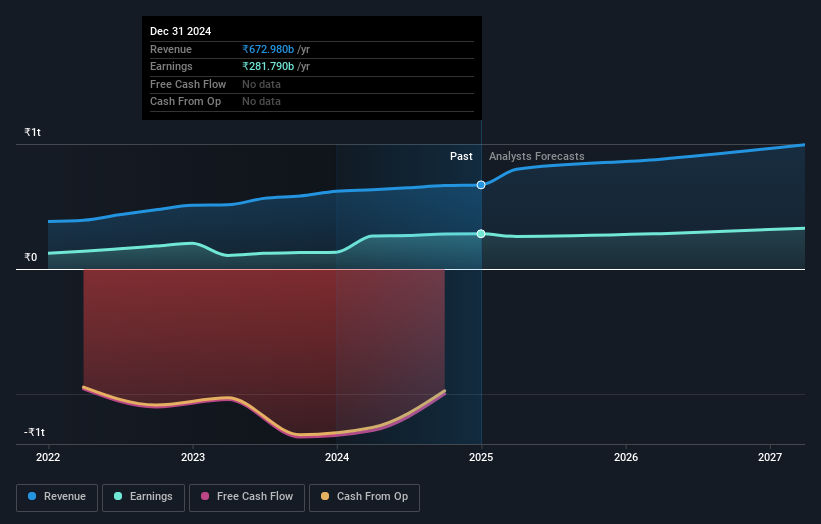

As of the latest data in October 2023, Axis Bank’s shares are trading at approximately ₹900, showing an upward trajectory over the past few months. The stock has recorded an impressive gain of about 20% year-to-date, reflecting positive investor sentiment and robust financial performance.

Several factors have contributed to this increase. The bank’s recent quarterly earnings report demonstrated a substantial rise in net profits, driven largely by an increase in net interest income and improved asset quality. Axis Bank also reported a significant decrease in non-performing assets (NPAs), which has bolstered investor confidence.

Market Analysis

The Indian banking sector has been buoyed by favorable economic indicators, including increasing credit demand and a gradual recovery from the pandemic. Analysts point out that Axis Bank’s strategic initiatives, including its focus on technology-driven banking and expanding its retail customer base, position it favorably within this context.

Moreover, analysts from multiple brokerage firms have updated their target prices for Axis Bank shares, with estimates ranging from ₹950 to ₹1,050 over the next 12-month period. This optimistic outlook is based on the bank’s strong fundamentals and strategic growth plans.

Future Outlook

As we look ahead, Axis Bank’s share price is likely to be influenced by several factors, including overall economic performance, regulatory changes, and competition in the banking sector. Investors are advised to keep an eye on upcoming financial results, as any negative surprises could impact share price adversely.

In conclusion, Axis Bank continues to show robust growth potential, making it a key player in the banking sector. Investors should remain informed about the latest developments affecting the bank’s stock, ensuring they are prepared to make timely decisions based on market fluctuations.