Atlanta Electricals IPO Price: What Investors Need to Know

Introduction

The upcoming IPO of Atlanta Electricals has generated significant interest in the stock market, highlighting the company’s strategic growth plans and strong financial performance. As an important milestone for the firm, understanding the IPO price is crucial for potential investors and market analysts alike, as it can influence market dynamics and investment strategies.

Details about the IPO

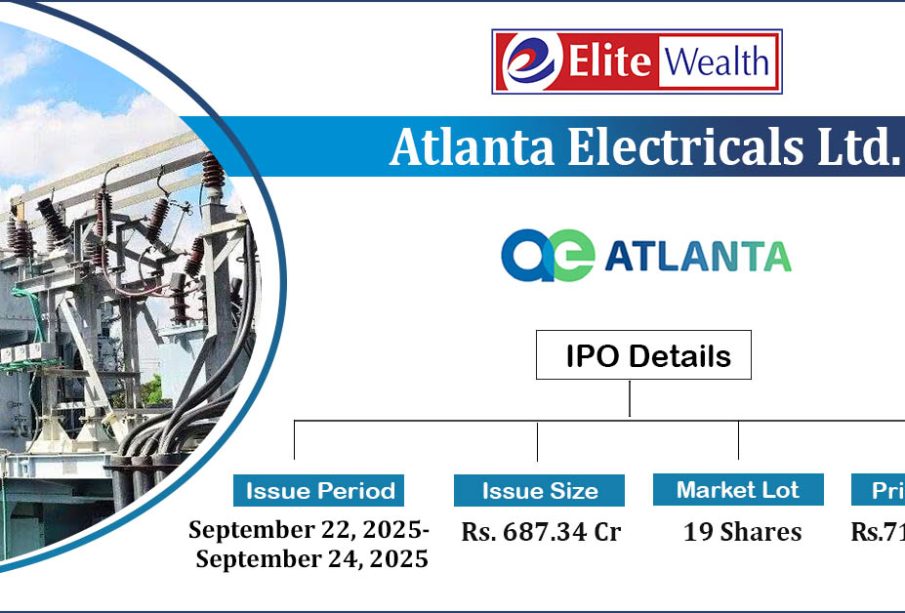

Atlanta Electricals has officially announced its Initial Public Offering (IPO) price range set between ₹250 and ₹275 per share. The company is aiming to raise approximately ₹1,500 crores through this public offering, which will likely include a fresh issue of equity shares worth ₹1,000 crores and an offer-for-sale portion of ₹500 crores. The IPO is expected to open on November 10, 2023, and close on November 14, 2023.

Company Profile

Atlanta Electricals, established in 1997, specializes in manufacturing and supplying electrical components and services. Known for its innovation and quality, the company has seen steady growth over the past few years. According to their latest financial reports, Atlanta Electricals has registered a revenue of ₹2,700 crores in FY 2023, marking a compound annual growth rate (CAGR) of 15% over the last five years. This attractive growth trajectory has bolstered investor interest ahead of the IPO.

Market Sentiment

The Indian IPO market has been bustling this year, with many companies successfully tapping into public equity for growth. Financial analysts are closely monitoring Atlanta Electricals’ IPO as a litmus test for investor confidence in the electrical sector. The company’s efficient business model and expansion plans are setting a positive tone, especially in light of the increasing demand for electrical products amid a growing economy.

Conclusion

As Atlanta Electricals prepares to embark on its IPO journey, the price range of ₹250 to ₹275 per share has caught the attention of investors looking for growth opportunities. With a solid business foundation and a promising market outlook, this IPO could pave the way for new investment avenues within the electrical sector. Investors should stay tuned for the opening date and evaluate their strategies accordingly to capitalize on what might be a significant offering in the current market landscape.