Anant Raj Share Price: Current Trends and Insights

Introduction

The share price of Anant Raj Limited, a prominent player in the Indian real estate sector, has drawn significant attention from investors recently. Understanding the fluctuations in Anant Raj’s share price is crucial for investors aiming to make informed decisions. Given the dynamic nature of the stock market, especially in a post-pandemic economy, tracking these movements can offer insights into broader market trends.

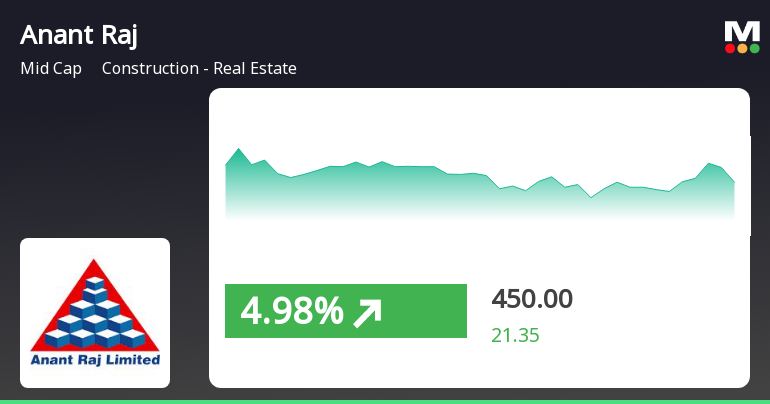

Current Share Price Performance

As of the latest trading session, Anant Raj’s share price stands at Rs. 125, reflecting a modest increase of 2.5% from the previous week. The stock has shown considerable volatility over the past few months, with a 52-week high of Rs. 150 and a low of Rs. 90. Analysts attribute this fluctuation to a combination of external market forces and the company’s strategic business decisions, including expansion plans and new project launches.

Factors Influencing Share Price

Several factors have been cited as influencing Anant Raj’s share price:

- Market Sentiment: General market trends have a profound effect. A bullish sentiment in the real estate sector has positively impacted the stock.

- Company Performance: Recent financial results indicate a year-on-year revenue growth of 15%, which has boosted investor confidence.

- Government Policies: The Indian government’s favorable policies towards real estate development and infrastructure projects have also played a role in enhancing the company’s outlook.

Recent Developments

Recently, Anant Raj announced the launch of a new residential project in Gurugram, which is expected to cater to the growing demand for housing in the National Capital Region (NCR). This project alone is projected to generate significant revenue for the company and enhance its profit margins, which may positively influence its share price.

Conclusion

In conclusion, Anant Raj’s share price is influenced by a multitude of factors including market trends, company performance, and external economic policies. As the company continues to expand and adapt to market needs, investors should monitor its share price closely. Given the anticipated growth in the real estate sector, analysts forecast a potential upward trend in the stock over the next few quarters, making it a noteworthy consideration for both seasoned investors and newcomers alike.