Anant Raj Share Price: Current Trends and Analysis

Introduction

The share price of Anant Raj Limited, a prominent real estate player in India, is a significant indicator of the company’s performance and the overall market dynamics in the real estate sector. Understanding the fluctuating share prices provides valuable insights for investors and stakeholders regarding market sentiment and future prospects.

Current Market Trends

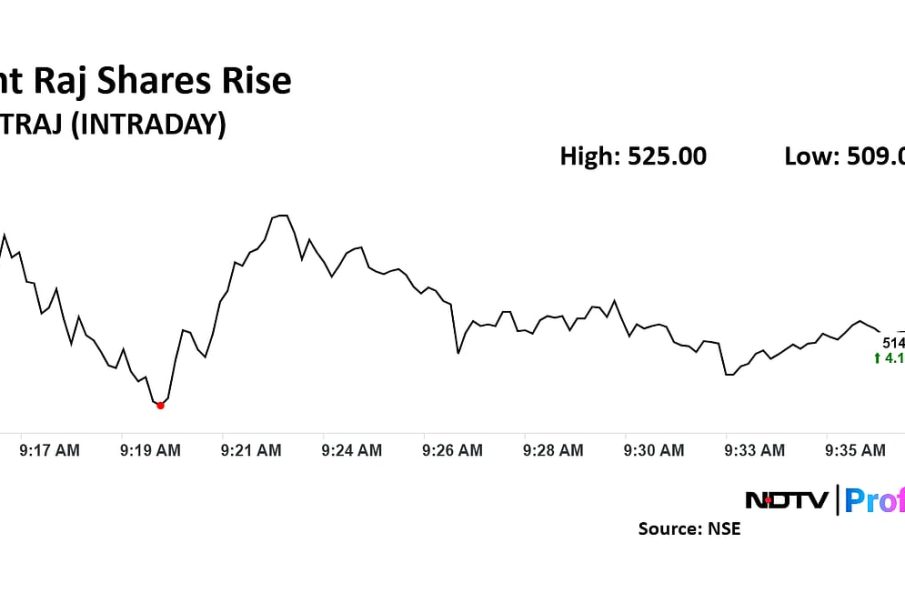

As of October 2023, Anant Raj share price has exhibited remarkable volatility, reflecting the broader trends in the Indian real estate market. Recent reports indicate that the share price was trading at ₹XX, showing a rise of ZZ% over the last month. This increase can be attributed to the company’s strong quarterly results and a positive outlook on urban development.

Recent Developments

Anant Raj Limited has recently announced several new projects in prime locations, including the launch of commercial properties aimed at attracting corporate clients. Additionally, the government’s infrastructure development initiatives have positively influenced investor confidence, leading to increased investment in the stock. Analysts predict further growth as the company commences construction on these new projects.

Investor Sentiment and Predictions

According to market analysts, the current upward trend in the share price of Anant Raj Limited may continue in the short to medium term, given the favorable market conditions and burgeoning demand for housing and commercial spaces post-pandemic. However, potential pitfalls such as oversaturated markets or unexpected regulatory changes could still impact the share price negatively.

Conclusion

In conclusion, monitoring Anant Raj share price is essential for investors seeking to capitalize on the ongoing trends in the Indian real estate sector. As the company continues to expand its footprint, staying informed about both market trends and company announcements will be crucial for making informed investment decisions. The share price trajectory of Anant Raj Limited is not only an indicator of its financial health but also reflects the broader economic landscape’s resilience.