Anand Rathi Share Price: Current Trends and Insights

Introduction

Anand Rathi is a prominent financial services firm in India that offers a wide range of services, including wealth management and investment banking. The share price of Anand Rathi is of significant interest to investors as it reflects the firm’s performance in the financial sector. This article explores the recent trends and factors influencing the share price of Anand Rathi, making it relevant for stakeholders and potential investors.

Recent Trends in Anand Rathi Share Price

As of October 2023, Anand Rathi’s share price has shown considerable volatility, which is often characteristic of the financial services sector. According to the Bombay Stock Exchange (BSE), the current share price is approximately ₹450, with a 52-week range of ₹350 to ₹550. This fluctuation has been influenced by several factors, including market conditions, investor sentiment, and developments within the company.

Factors Affecting Share Price

1. Market Dynamics: The broader market trends have a significant impact on Anand Rathi’s share price. The ongoing volatility in the Indian stock market, fueled by economic policies and global cues, has created uncertainty for many financial stocks.

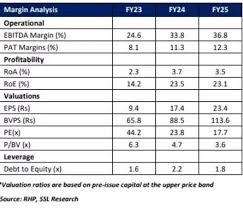

2. Company Performance: Anand Rathi’s quarterly earnings reports are critical indicators of its financial health. Investors reacted positively to the latest quarterly results, which reported a 15% increase in net profit year-on-year, bolstering investor confidence.

3. Regulatory Changes: Changes in regulations affecting financial markets in India can directly impact Anand Rathi’s operations and, consequently, its share price. Recent updates from the Securities and Exchange Board of India (SEBI) about compliance and transparency have created new opportunities and challenges for the firm.

Investment Outlook

Market analysts have mixed opinions on the short-term outlook for Anand Rathi shares. While some predict that the share price may stabilize around the ₹450 mark, others forecast potential upward movement if the company continues to deliver strong financial results and navigate market challenges effectively.

Conclusion

In conclusion, the Anand Rathi share price remains a crucial point of interest for investors. While current trends suggest a phase of recovery tied to company performance, broader market conditions will largely dictate future movements. Stakeholders should remain informed on both internal and external factors influencing financial markets, as this will aid in making educated investment decisions for the future.