Analyzing the SJVN Share Price: Recent Trends and Future Outlook

Introduction

The share price of Satluj Jal Vidyut Nigam Limited (SJVN) has recently garnered significant attention from investors and analysts alike. As a public sector enterprise involved in hydroelectric power generation, the performance of SJVN’s shares is particularly relevant in the context of India’s growing energy sector and the government’s push for renewable energy resources. In this article, we explore the recent trends, fluctuations, and forecasts regarding the SJVN share price.

Recent Trends in SJVN Share Price

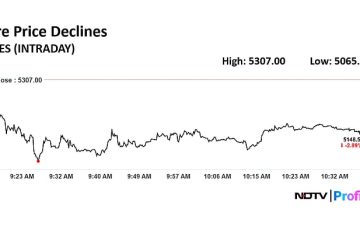

As of October 2023, the SJVN share price has shown considerable volatility. The stock opened the month at approximately ₹30 and witnessed a steady climb, peaking at ₹34 by mid-month, driven by positive quarterly results that indicated a significant increase in electricity generation and revenue. This uptrend was aided by supportive government policies aimed at boosting green energy initiatives, which soothed investor sentiment.

However, the latter part of October saw a correction, with the stock retracing to around ₹32, spurred by a broader market pullback in response to inflation concerns and oil price fluctuations. Despite this fluctuation, analysts remain optimistic about the long-term growth prospects of SJVN, given the company’s robust project pipeline and planned expansions into solar and wind energy sectors.

Market Factors Influencing SJVN’s Share Price

Several elements have a direct impact on the share price of SJVN. These include regulatory changes in the energy sector, increased competition from private players, and macroeconomic factors such as interest rates and global energy prices. Additionally, the government’s continued commitment to increasing the share of renewable energy in the overall energy mix is expected to further the company’s growth trajectory.

Recent announcements about new hydroelectric projects and the company’s strategy to enhance its capacity through diversification into other energy sources have also positively influenced investor confidence. Furthermore, with rising global concerns about climate change, companies like SJVN that are focused on renewable energy sources are becoming increasingly attractive to ESG-conscious investors.

Conclusion and Future Outlook

The SJVN share price reflects not just the company’s performance but also the larger trends in India’s energy landscape. Analysts predict that the stock will stabilize around the ₹32-₹35 range as investors digest the recent performance and look forward to upcoming project announcements. Overall, SJVN is well-positioned to benefit from the ongoing shifts in the energy sector toward sustainability and clean energy. Potential investors should consider both the short-term fluctuations and the long-term growth potential grounded in government policy and global energy trends.