Analyzing the Recent Trends in Concor Share Price

Introduction

The share price of Container Corporation of India Limited (Concor) stands as a crucial indicator of the company’s performance and the overall health of the logistics sector in India. With rising demand for freight services and the government’s push for infrastructure development, tracking changes in Concor’s share price is essential for investors and stakeholders alike.

Current Trends and Market Performance

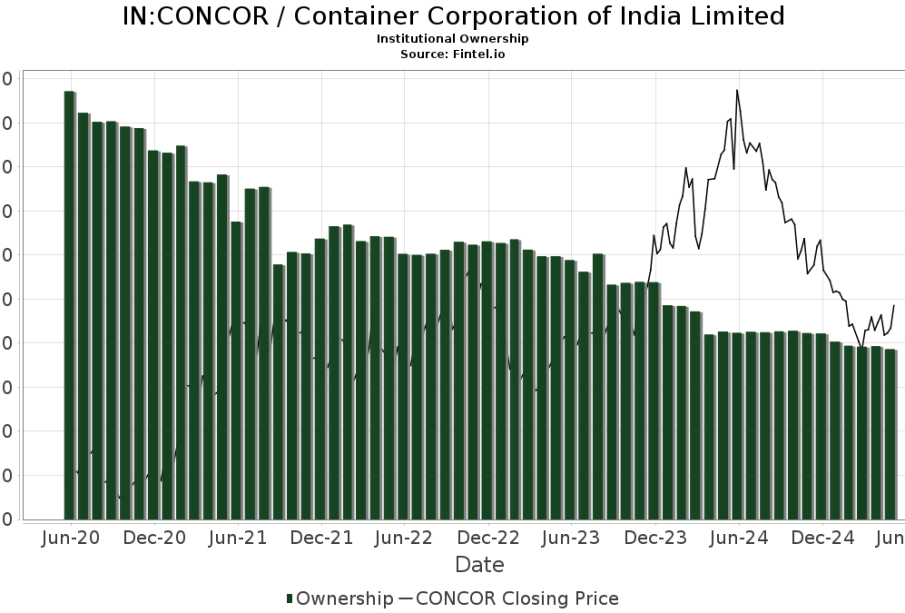

As of October 2023, Concor shares have witnessed notable fluctuations. After reaching an all-time high of INR 800 per share in September, the price has recently adjusted to around INR 750 due to market corrections and profit booking. Analysts attribute this decline partly to broader market sentiments, which have been influenced by inflationary pressures and interest rate hikes implemented by the Reserve Bank of India.

Investors have shown a keen interest in Concor due to its strategic initiatives, including the expansion of its logistics networks and partnerships with major domestic and international players. The company’s commitment to modernizing its container terminals is expected to enhance its operational efficiency and service delivery, contributing positively to future earnings potential.

Factors Influencing Concor’s Share Price

Several factors impact the share price of Concor, including:

- Government Policies: Initiatives like the ‘Sagarmala Programme’ aimed at enhancing port connectivity and logistics infrastructure directly benefit Concor’s business model.

- Global Supply Chain Dynamics: Fluctuations in global shipping rates and demand for containerized transport can lead to volatile pricing for the firm.

- Financial Reporting: Quarterly earnings reports that reflect revenue growth, net profit margins, and cost control policies significantly influence investor perception and share valuation.

Conclusion

Overall, the outlook for Concor remains cautiously optimistic despite short-term volatility in its share price. Market experts suggest that as logistical demand continues to grow, driven by e-commerce and industrial activity, Concor is likely to reposition itself advantageously while adapting to regulatory changes and investing in technology. For investors, keeping a close watch on earnings reports and broader market shifts will be crucial in making informed decisions regarding the future of Concor shares.