Analyzing Swiggy Share Price Trends and Market Performance

Introduction

Swiggy, one of India’s leading food delivery platforms, has seen a significant impact on its share price following recent developments. As the company’s position in the market evolves, understanding its stock price movements becomes crucial for investors and stakeholders. This article explores the latest trends in Swiggy’s share price, the factors influencing these changes, and their relevance in the current economic landscape.

Current Market Overview

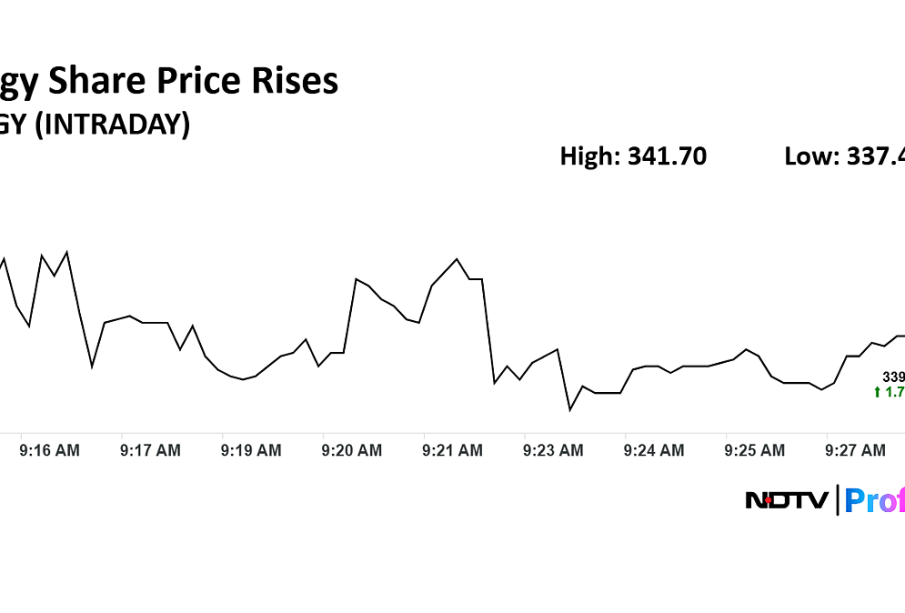

As of October 2023, Swiggy’s share price has shown a volatile pattern amid fluctuating market conditions and competitive pressures. Recent reports indicate that Swiggy’s stock was trading at around INR 700, with a notable increase of approximately 5% in the last week alone due to positive earnings forecasts and a surge in customer demand.

Factors Affecting Swiggy Share Price

The rise in Swiggy’s stock can be attributed to several key factors:

- Increased Revenue: Swiggy reported a 20% rise in its quarterly revenue, driven by strong growth in delivery services and expansion into new markets.

- Strategic Partnerships: The company has been actively partnering with various restaurants to enhance its offerings, which has positively impacted investor sentiment.

- Market Competition: With increasing competition from rivals like Zomato and other emerging food tech companies, Swiggy is already implementing strategies that promise sustained growth, ensuring better positioning in the market.

Investors’ Perspective

Investors are closely monitoring Swiggy’s performance, particularly with its initial public offering (IPO) on the horizon. Market analysts predict that if Swiggy continues to innovate and adapt to changing consumer behaviors, the share price may see further growth, potentially reaching INR 750 by the end of the year.

Conclusion

In conclusion, Swiggy’s share price remains a focal point for investors interested in the burgeoning food delivery sector in India. The company’s financial performance, strategic growth initiatives, and the competitive landscape will play critical roles in shaping investor confidence moving forward. As Swiggy moves closer to its IPO, both potential and current investors should remain vigilant and informed about the market trends that could influence share price fluctuations in the future.