Analyzing Power Grid Share Price Trends in the Current Market

Introduction

Power Grid Corporation of India Limited (PGCIL), a Maharatna company, is pivotal in India’s power sector, responsible for the transmission of electricity across the nation. Investing in Power Grid shares has garnered attention due to the company’s strong financial performance and strategic role in the infrastructure sector. Understanding the dynamics affecting the Power Grid share price is crucial for investors looking to navigate the stock market effectively.

Current Market Trends

As of October 2023, Power Grid’s share price has shown a significant upward trend, reflecting robust investor confidence. Trading at approximately INR 240, the stock has seen a rise of around 8% in the last month. Analysts attribute this growth to the company’s consistent quarterly performance, bolstered by the government’s focus on expanding renewable energy sources and improving the country’s power infrastructure.

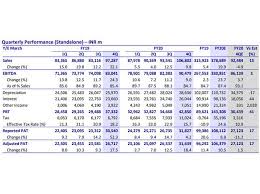

The company’s recent quarterly results reported a net profit of INR 3,200 crore, marking a 10% increase year-on-year. This growth is indicative of Power Grid’s strong operational efficacy and robust demand for electricity transmission. Furthermore, the company’s commitment to enhancing its transmission network aligns with India’s push towards sustainable energy solutions, providing a solid foundation for future growth.

Factors Influencing Share Price

Several factors influence the share price of Power Grid. These include:

- Government Policies: Favorable government initiatives and policies aimed at expanding electricity access across rural and urban sectors can positively impact PGCIL’s operations.

- Infrastructure Development: As India intensifies its efforts to develop infrastructure, particularly in renewable energy, Power Grid stands to benefit significantly.

- Market Conditions: General market sentiment and investor confidence play a critical role. Fluctuations in the overall stock market can also directly affect Power Grid’s share price.

Future Outlook

Looking ahead, analysts remain optimistic about Power Grid’s share price. Experts predict that the stock could reach INR 270 by early 2024, driven by anticipated growth in the renewable energy sector and ongoing infrastructure projects slated for completion. The company’s strategic initiatives, such as increasing its transmission capacity and diversifying its energy portfolio, are expected to further enhance its market position.

Conclusion

In conclusion, Power Grid remains a key player in India’s energy landscape, with its share price reflecting the company’s strong fundamentals and favorable market conditions. For investors, monitoring Power Grid’s share price offers insights into not just the company’s health but also the broader energy sector landscape in India. As the government continues to focus on expanding and modernizing the power sector, Power Grid’s growth trajectory appears promising.