Analyzing Current Trends in BHEL Share Price

Introduction

Bharat Heavy Electricals Limited (BHEL) is a public sector engineering and manufacturing company and one of the largest in its field in India. The share price of BHEL is significant as it reflects the company’s operational performance and market sentiment. Investors often track this price for insights into potential investment opportunities.

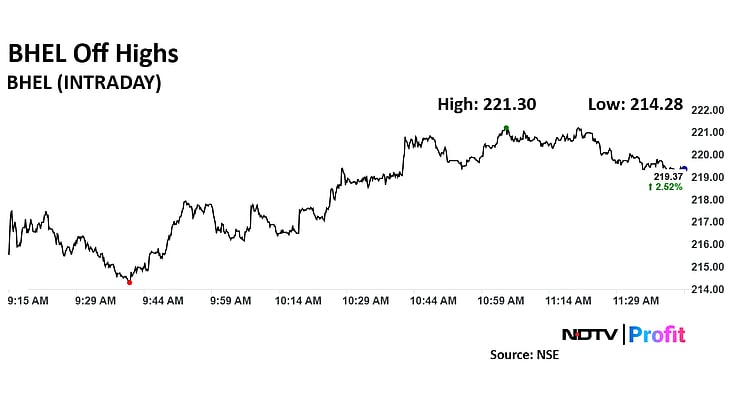

Current BHEL Share Price Trends

As of October 2023, BHEL’s share price has experienced fluctuations, closing at INR 88.50 on the Bombay Stock Exchange. Recently, the share price saw a rise of approximately 5% following the company’s announcement regarding a major contract win in renewable energy. This development indicates a positive market outlook towards BHEL’s expansions into sustainable technology.

Factors Influencing the Share Price

Several factors influence BHEL’s share price, including quarterly earnings reports, government policies on energy infrastructure, and developments in the renewable energy sector. The company reported a significant increase in demand for its products, primarily due to the Indian government’s push towards greener energy solutions. Analysts suggest that BHEL’s focus on modernization and innovation is likely to propel future growth, making it an attractive stock for long-term investment.

Market Analyst Outlook

Market analysts are maintaining a cautious yet optimistic stance on BHEL shares. Prediction models indicate that if BHEL continues its upward trajectory, the share price could potentially reach INR 100 by the end of the fiscal year. Increased investment in infrastructure by the government and international collaborations in renewable energy sectors are likely to play a key role in driving this growth.

Conclusion

In summary, BHEL’s share price currently reflects a combination of strong business fundamentals and positive market trends, particularly in the context of renewable energy. Investors are encouraged to monitor market developments closely as the company is poised for potential growth, which could yield significant returns in the near future. As always, investors should conduct thorough research or consult with financial advisors before making investment decisions.